150x Filetype PDF File size 0.12 MB Source: ipief.umy.ac.id

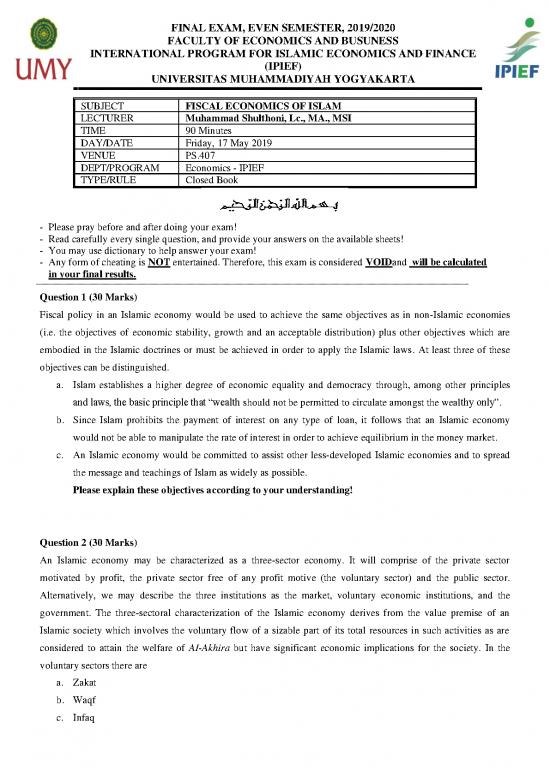

FINAL EXAM, EVEN SEMESTER, 2019/2020

FACULTY OF ECONOMICS AND BUSUNESS

INTERNATIONAL PROGRAM FOR ISLAMIC ECONOMICS AND FINANCE

(IPIEF)

UNIVERSITAS MUHAMMADIYAH YOGYAKARTA

SUBJECT FISCAL ECONOMICS OF ISLAM

LECTURER Muhammad Shulthoni, Lc., MA., MSI

TIME 90 Minutes

DAY/DATE Friday, 17 May 2019

VENUE PS.407

DEPT/PROGRAM Economics - IPIEF

TYPE/RULE Closed Book

- Please pray before and after doing your exam!

- Read carefully every single question, and provide your answers on the available sheets!

- You may use dictionary to help answer your exam!

- Any form of cheating is NOT entertained. Therefore, this exam is considered VOIDand will be calculated

in your final results.

Question 1 (30 Marks)

Fiscal policy in an Islamic economy would be used to achieve the same objectives as in non-Islamic economies

(i.e. the objectives of economic stability, growth and an acceptable distribution) plus other objectives which are

embodied in the Islamic doctrines or must be achieved in order to apply the Islamic laws. At least three of these

objectives can be distinguished.

a. Islam establishes a higher degree of economic equality and democracy through, among other principles

and laws, the basic principle that “wealth should not be permitted to circulate amongst the wealthy only”.

b. Since Islam prohibits the payment of interest on any type of loan, it follows that an Islamic economy

would not be able to manipulate the rate of interest in order to achieve equilibrium in the money market.

c. An Islamic economy would be committed to assist other less-developed Islamic economies and to spread

the message and teachings of Islam as widely as possible.

Please explain these objectives according to your understanding!

Question 2 (30 Marks)

An Islamic economy may be characterized as a three-sector economy. It will comprise of the private sector

motivated by profit, the private sector free of any profit motive (the voluntary sector) and the public sector.

Alternatively, we may describe the three institutions as the market, voluntary economic institutions, and the

government. The three-sectoral characterization of the Islamic economy derives from the value premise of an

Islamic society which involves the voluntary flow of a sizable part of its total resources in such activities as are

considered to attain the welfare of AI-Akhira but have significant economic implications for the society. In the

voluntary sectors there are

a. Zakat

b. Waqf

c. Infaq

d. Sedekah

Please explain these elements that can be the complementary to modern taxation!

Question 3 (30 Marks)

How do the islamic fiscal tools work to achieve:

a. Full employment,

b. To curb inflation and

c. To mobilize savings in order to accelerate economic growth?

Question 4 (40 Marks)

In the final analysis, hopes for a brighter future in Muslim countries are integrally linked with the scope for reform.

Although the external environment is important, the first step is for Muslim countries to put their own houses in

order and implement taxation and expenditure policies that reflect the norms of equity and the aspirations of their

own people. This means work on a number of fronts: rethinking governance, re-establishing supremacy of law,

reforming taxation in line with domestic income and wealth profile and economic priorities, facilitating an

appropriate investment profile and climate, and reconsidering expenditure priorities. According to the article, there

are policy recommendations (agenda for action) that correspond with the original vision of Islam, starting with the

connection between taxation and governance.

Part I

a. Gain the Trust and Confidence of Taxpayers

b. Close the Constitutional Gates to Rent-Seeking

c. Reform Public Expenditure as Well as Taxation

d. Institutionalize Savings

e. Promote Investment

Please explain these recommendations!

Part II

There are many problems of Implementing Taxation in Muslim Countries such as

a. Economic Structure and Organization

b. Skewwed Distribution of Income and Wealth

c. Poor Governance

d. Lobbying and Corruption

e. Imbalances in International Trade

Please explain these problems!

Good Luck!

no reviews yet

Please Login to review.