333x Filetype XLSX File size 0.16 MB Source: www.ccab.com

Sheet 1: Tab 1 - Cover Sheet

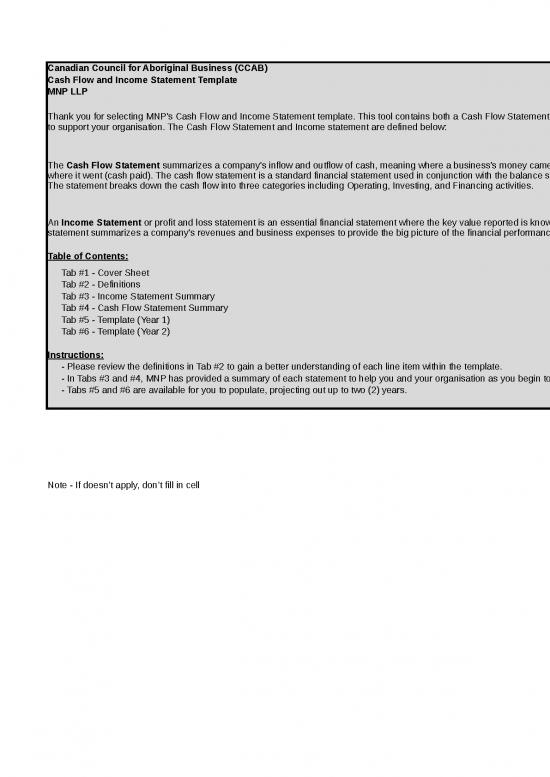

| Canadian Council for Aboriginal Business (CCAB) |

| Cash Flow and Income Statement Template |

| MNP LLP |

| Thank you for selecting MNP's Cash Flow and Income Statement template. This tool contains both a Cash Flow Statement and an Income Statement to support your organisation. The Cash Flow Statement and Income statement are defined below: |

| The Cash Flow Statement summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash received) and where it went (cash paid). The cash flow statement is a standard financial statement used in conjunction with the balance sheet and income statement. The statement breaks down the cash flow into three categories including Operating, Investing, and Financing activities. |

| An Income Statement or profit and loss statement is an essential financial statement where the key value reported is known as Net Income. The statement summarizes a company's revenues and business expenses to provide the big picture of the financial performance of a company over time. |

| Table of Contents: |

| Tab #1 - Cover Sheet |

| Tab #2 - Definitions |

| Tab #3 - Income Statement Summary |

| Tab #4 - Cash Flow Statement Summary |

| Tab #5 - Template (Year 1) |

| Tab #6 - Template (Year 2) |

| Instructions: |

| - Please review the definitions in Tab #2 to gain a better understanding of each line item within the template. |

| - In Tabs #3 and #4, MNP has provided a summary of each statement to help you and your organisation as you begin to populate the template. |

| - Tabs #5 and #6 are available for you to populate, projecting out up to two (2) years. |

| Note - If doesn’t apply, don’t fill in cell |

| Key Terms & Definitions |

| Operating Section: |

| Revenue - Cash inflows or other enhancements of assets (including accounts receivable) of an entity during a period from delivering or producing goods, rendering services, or other activities that constitute the entity's ongoing major operations. It is usually presented as sales minus sales discounts, returns, and allowances. Every time a business sells a product or performs a service, it obtains revenue. This often is referred to as gross revenue or sales revenue. |

| Expenses - Cash outflows or other using-up of assets or incurrence of liabilities (including accounts payable) during a period from delivering or producing goods, rendering services, or carrying out other activities that constitute the entity's ongoing major operations. |

| Cost of Goods Sold (COGS) / Cost of Sales - represents the direct costs attributable to goods produced and sold by a business (manufacturing or merchandizing). It includes material costs, direct labour, and overhead costs (as in absorption costing), and excludes operating costs (period costs) such as selling, administrative, advertising or R&D, etc. |

| Selling, General and Administrative expenses (SG&A or SGA) - consist of the combined payroll costs. SGA is usually understood as a major portion of non-production related costs, in contrast to production costs such as direct labour. |

| Selling expenses - represent expenses needed to sell products (e.g., salaries of sales people, commissions and travel expenses, advertising, freight, shipping, depreciation of sales store buildings and equipment, etc.). |

| General and Administrative (G&A) expenses - represent expenses to manage the business (salaries of officers / executives, legal and professional fees, utilities, insurance, depreciation of office building and equipment, office rents, office supplies, etc.). |

| Depreciation / Amortization - the charge with respect to fixed assets / intangible assets that have been capitalised on the balance sheet for a specific (accounting) period. It is a systematic and rational allocation of cost rather than the recognition of market value decrement. |

| Research & Development (R&D) expenses - represent expenses included in research and development. |

| Note - Expenses recognised in the income statement should be analysed either by nature (raw materials, transport costs, staffing costs, depreciation, employee benefit etc.) or by function (cost of sales, selling, administrative, etc.). If an entity categorises by function, then additional information on the nature of expenses, at least, – depreciation, amortisation and employee benefits expense – must be disclosed. The major exclusive of costs of goods sold, are classified as operating expenses. These represent the resources expended, except for inventory purchases, in generating the revenue for the period. Expenses often are divided into two broad sub classifications selling expenses and administrative expenses. |

| Non-Operating Section: |

| Other revenues or gains - revenues and gains from other than primary business activities (e.g., rent, income from patents, goodwill). It also includes unusual gains that are either unusual or infrequent, but not both (e.g., gain from sale of securities or gain from disposal of fixed assets). |

| Other expenses or losses - expenses or losses not related to primary business operations, (e.g., foreign exchange loss). |

| Finance costs - costs of borrowing from various creditors (e.g., interest expenses, bank charges). |

| Income tax expense - sum of the amount of tax payable to tax authorities in the current reporting period (current tax liabilities/ tax payable) and the amount of deferred tax liabilities (or assets). |

| Irregular Items: |

| They are reported separately because this way users can better predict future cash flows - irregular items most likely will not recur. These are reported net of taxes. Discontinued operations is the most common type of irregular items. Shifting business location(s), stopping production temporarily, or changes due to technological improvement do not qualify as discontinued operations. Discontinued operations must be shown separately. Cumulative effect of changes in accounting policies (principles) is the difference between the book value of the affected assets (or liabilities) under the old policy (principle) and what the book value would have been if the new principle had been applied in the prior periods. For example, valuation of inventories using LIFO (last in, first out) instead of weighted average method. The changes should be applied retrospectively and shown as adjustments to the beginning balance of affected components in Equity. All comparative financial statements should be restated. |

| Bottom Line: |

| “Bottom line” is the net income that is calculated after subtracting the expenses from revenue. Since this forms the last line of the income statement, it is informally called “bottom line.” It is important to investors as it represents the profit for the year attributable to the shareholders. |

| Income Statement The income statement summarizes the financial activities of a business during a particular accounting period (which can be a month, quarter, year, or some other period of time that makes sense for a business’s needs). The five key lines that make up an income statement are: Sales or Revenue: The total amount of money taken in from selling the business’s products or services. You calculate this amount by totaling all the sales or revenue accounts. The top line of the income statement will be either sales or revenues; either is okay. Cost of Goods Sold: How much was spent in order to buy or make the goods or services that were sold during the accounting period in review. Gross Profit: How much a business made before taking into account operations expenses; calculated by subtracting the Cost of Goods Sold from the Sales or Revenue. Operating Expenses: How much was spent on operating the business; qualifying expenses include administrative fees, salaries, advertising, utilities, and other operations expenses. You add all your expenses accounts on your income statement to get this total. Net Income or Loss: Whether or not the business made a profit or loss during the accounting period in review; calculated by subtracting total expenses from Gross Profit. |

| Section 1: Gross Revenue In business finance, gross revenue refers to the total of all sales income collected by your business without subtracting any costs. Depending on your business, your revenue may come from sales of a single product or product line or from a number of different products and services. If you have more than one revenue stream, itemize revenues from each source so that you can see at a glance where your revenue is really coming from and then add the categories to arrive at your gross revenue. |

| Section 2: Cost of Sales Cost of Sales is the total amount your company spent to buy or make the goods or services that you sold. To calculate this amount for a company that buys its finished products from another company in order to sell them to customers, you start with the value of the company’s opening inventory, add all purchases of new inventory, and then subtract any ending inventory (that’s inventory that’s still on the store shelves or in the warehouse; it appears on the balance sheet). |

| Section 3: Gross Profit In general, profit is the money that you get to keep after all the bills are paid. Gross profit, also called gross income, is the first stage of profit. It equals gross revenue minus the costs of goods sold, which covers the costs directly associated with producing, assembling, or purchasing what you have to sell. To a service business, costs of goods sold include costs directly related to supplying or delivering the service. To a manufacturer, costs of goods sold include costs for raw materials and the labor, utilities, and facilities needed to put the product together. |

| Section 4: Operating Expenses To arrive at your overall net profit or loss, you must next subtract Operating Expenses and Depreciation. Operating expenses, also know as general and administrative expenses or SG&A (sales, general, and administration expenses), include the costs involved in operating your business, including salaries, research and development costs, marketing expenses, travel and entertainment, utility bills, rent, office supplies, and other overhead expenses. When you purchase big-ticket items for your business — maybe a car to call on clients, a computer system, or even a building for offices, warehouse space, or other facilities — what you’re really doing is exchanging one asset for another asset. The business assets you acquire all have useful life spans, so one way to spread out the costs of these assets over the number of years they’re actually in service is to calculate and deduct depreciation expenses each year. Net profit (loss) = Gross profit ‒ Operating expenses and Depreciation Expenses When calculating your operating profit, watch your overhead expenses like a hawk. If they get out of line, they can quickly eat away at your gross profits. |

| Section 5: Earnings Before Tax If applicable, your business net profit (loss) may be subject to tax. It will be important for your business to apply the correct tax rate to your net profit (loss) to calculate what will be remitted to the Canada Revenue Agency. Depending on how you structured your company, your business may or may not pay taxes directly on its profits. If you’re a sole proprietor or if your business is a partnership, for example, your profits are funneled straight to the owners for tax purposes. But if your business is incorporated and pays taxes, you need to subtract those taxes before you state your final profit. |

| Section 6: Net Profit (Loss) Net profit (also called net earnings, net income, or bottom line) is what’s left after you subtract your final expenses from your total business income. |

no reviews yet

Please Login to review.