241x Filetype PDF File size 0.21 MB Source: www.gravitaslegal.co.in

Demystifying the difference between One Person Company, Limited Liability Partnership and Private Limited Company

Authored by Priyanka Bharti, Partner and Anubhav Chakravorty, Associate

India is an emerging market with expansive scope and opportunities for Indian and foreign investors alike. As a result, many companies continue to

target expansion by establishing their businesses in India. Investors can decide the legal structure within which their businesses will operate, based

on the purpose, objective, initial investment, risk appetite and duration (short term/long term) of the business. The commercial law in India lays

down several mechanisms for the establishment and functioning of different types of commercial entities; each having distinguishable attributes,

prerequisites for incorporation, and conversion mechanisms. Through this article, we aim to demystify three types of companies in India (One Person

Company, Limited Liability Partnership and Private Limited Company) and share a comprehensive understanding of their differences.

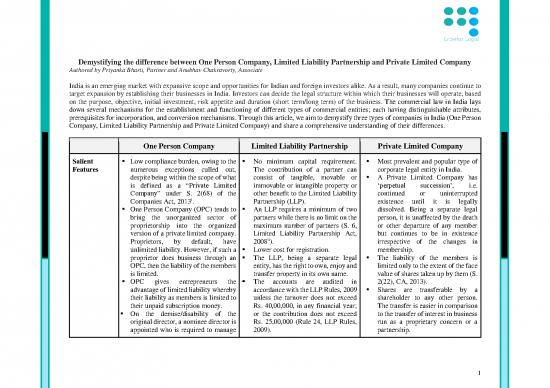

One Person Company Limited Liability Partnership Private Limited Company

Salient Low compliance burden, owing to the No minimum capital requirement. Most prevalent and popular type of

Features numerous exceptions culled out, The contribution of a partner can corporate legal entity in India.

despite being within the scope of what consist of tangible, movable or A Private Limited Company has

is defined as a “Private Limited immovable or intangible property or ‘perpetual succession’, i.e.

Company” under S. 2(68) of the other benefit to the Limited Liability continued or uninterrupted

i

Companies Act, 2013. Partnership (LLP). existence until it is legally

One Person Company (OPC) tends to An LLP requires a minimum of two dissolved. Being a separate legal

bring the unorganized sector of partners while there is no limit on the person, it is unaffected by the death

proprietorship into the organized maximum number of partners (S. 6, or other departure of any member

version of a private limited company. Limited Liability Partnership Act, but continues to be in existence

ii

Proprietors, by default, have 2008 ). irrespective of the changes in

unlimited liability. However, if such a Lower cost for registration. membership.

proprietor does business through an The LLP, being a separate legal The liability of the members is

OPC, then the liability of the members entity, has the right to own, enjoy and limited only to the extent of the face

is limited. transfer property in its own name. value of shares taken up by them (S.

OPC gives entrepreneurs the The accounts are audited in 2(22), CA, 2013).

advantage of limited liability whereby accordance with the LLP Rules, 2009 Shares are transferable by a

their liability as members is limited to unless the turnover does not exceed shareholder to any other person.

their unpaid subscription money. Rs. 40,00,000, in any financial year; The transfer is easier in comparison

On the demise/disability of the or the contribution does not exceed to the transfer of interest in business

original director, a nominee director is Rs. 25,00,000 (Rule 24, LLP Rules, run as a proprietary concern or a

appointed who is required to manage 2009). partnership.

1

the affairs of the company till the date LLP is liable for payment of income A company being a juristic person,

of transmission of shares to legal heirs tax but the share of its partners in can acquire, own, enjoy and alienate

of the demised member (S. 4(1)(f), LLP is not liable to tax. Thus, no property in its own name.

CA, 2013). dividend distribution tax is payable. Being an independent legal entity, it

OPC’s can appoint as many as 15 Provision of ‘deemed dividend’ can sue and also be sued in its own

directors for administrative functions, under income tax law is not name.

without giving any share to them. applicable to LLP (S. 40(b), CA, It can make a valid and effective

There is no requirement to hold 2013). contract with any of its members. It

Annual or Extra Ordinary General is also possible for a person to be in

Meetings. Only a resolution is control of the company and at the

required to be communicated by the same time be in its employment.

member of the company, and entered Thus, a person can at the same time

into the minutes’ book with the date be a shareholder, creditor, director

and signature. Such date is deemed to and also an employee of the Private

be the date of meeting (S. 96 (1), CA, Limited Company.

2013). It can issue debentures (secured as

Provisions of S. 174 (Quorum for well as unsecured) and can also

meetings of Board) don’t apply to a accept deposits from the public, etc.

One Person Company in which there

is only one director on its Board of

Directors.

Where the OPC has only one director,

all the businesses to be at the

transacted meeting of the Board is

required to be entered into the

minutes’ book maintained under S.

118 (S. 122(3), 122(4), CA, 2013). In

this case, there is no additional

requirement to hold Board Meetings

(S. 96(1)), CA, 2013).

The cost for registration of an OPC is

lower and there are fewer filings with

the Registrar of Companies (ROC).

The mandatory rotation of auditor

after expiry of the maximum term is

2

not applicable.

Provisions of S. 98 and S. 100-111,

relating to holding of general

meetings do not apply to a One Person

Company (S. 122 (1), CA, 2013).

OPC is an artificial entity distinct

from its owner. Thus, the claims made

against the business cannot be pressed

against the owner and there is

perpetual succession.

Requirements At least one shareholder; At least two partners (not cooperative A minimum of two directors, and

At least one director; societies, minors) with at least one maximum of 15 (One needs to be

The director and shareholder can be partner being an Indian resident (S. 6, Indian Resident and Indian

the same person; LLP Act, 2008). national) (S. 3(1)(b), 149(1)(b), CA,

At least one nominee director (cannot The fee for registration of LLP 2013).

be a minor); including conversion of a firm or a Two persons are also required to act

Only a natural person who is an Indian private company or an unlisted as shareholders of a company. The

Citizen and resident in India may form public company into LLP: shareholders can be natural persons

an OPC; LLP whose contribution is limited or an artificial legal entity

Share Capital of at least Rs. 1,00,000; to Rs 1,00,000: fee of Rs. 500. (Maximum 200) (S. 2(68)(ii), CA,

‘OPC’ to be suffixed with the name of LLP whose contribution exceeds 2013).

OPCs to distinguish it from the other Rs 1,00,000 but is limited to Rs Minimum capital contribution

companies (S. 12(3), CA, 2013); 5,00,000: fee of Rs. 2,000. required for a private limited

At least one meeting of the Board of LLP whose contribution exceeds company is Rs. 1,00,000.

Directors in each half of a calendar Rs 5,00,000 but is limited to Rs An address in India where the

year where the gap between the two 10,00,000: fee of Rs. 4,000. registered office of the Company

meetings shall not be less than 90 days LLP whose contribution exceeds will be situated is required. The

(unless there’s only one director) (S. Rs 10,00,000: fee of Rs. 5,000. (5, premises can be a

173(5), CA, 2013); and Annexure A, LLP Rules, 2009) commercial/industrial/residential

Filing of the financial statements duly Name should not include something where communication from the

adopted by its member, along with all prohibited under the Emblems and MCA will be received.

the documents which are required to Names Act, 1950 (Rule 18, LLP

be attached to such financial Rules, 2009).

statements, within 180 days from the Should not belong to the excluded list

3

closure of the financial year (S. 137, of names (Rule 18, LLP Rules,

CA, 2013). 2009).

Minute book to be maintained to

record minutes of meetings of

partners. However, the LLP Act does

not prescribe compulsory meetings

of partners. Partners may be called

for events prescribed in the LLP

Agreement.

Statement of account and solvency is

required to be filed annually.

If the LLP has a turnover of less than

Rs. 40,00,000 and a capital

contribution of less than Rs.

25,00,000; there are no audit

requirements.

FDI in LLP requires prior RBI

approval. (Annex I to A. P. (DIR

Series) Circular No. 123 dated April

16, 2014)

Conversions To LLP: To OPC: Cannot be done as LLP To OPC:

Cannot be done as at least two members requires at least two members. A Board Meeting must be

are required to be partners in LLP conducted to get in-principal

(Section 6, LLP Act, 2008). approval of the Directors and fix

date, time and place for conducting

EGM to obtain the approval of the

shareholders of the private limited

company by means of a special

resolution.

Hence, at the Board Meeting, a

support notice of EGM along with

Agenda and Explanatory Statement

should be annexed to the notice of

General Meeting according to the

4

no reviews yet

Please Login to review.