100x Filetype PDF File size 0.18 MB Source: cmaaustralia.edu.au

JAMAR Vol. 9 · No. 2· 2011

Research Note

Introduction

A New Framework for This paper extends Yahya-Zadeh (2002) to

Capacity Costing and integrate inventory variances into flexible

Inventory Variance budgeting and profit variance analysis. While

traditional profit variance analysis "flexes" the

Analysis static budget to actual sales volume, Yahya-

Zadeh (2002) argued that a more appropriate

benchmark for measuring the performance of a

Massood Yahya-Zadeh* firm or its profit centres would be an ex post

optimal budget. An ex post optimal budget, it

Abstract was argued, was the result of an optimization

program using the latest data available by the

The proposed framework in this article end of the budget period. Using linear

presents a new framework for capacity programming as the optimization tool, the

costing and inventory variance analysis by study showed that changes in market

introducing linear programming (LP) into conditions, such as a change in the firm's

variance analysis to allow for optimal relative output and input prices, could render a

budgeting in a firm with two production traditional flexible budget misleading.

departments and two products. In Measuring and rewarding responsibility centre

addition, the proposed framework managers for achieving outdated budget

replaces the traditional concept of ex ante targets could lead some profit centre managers

flexible budget, with the concept of ex post to increase production of the wrong

flexible budget, which allows management department or the wrong product.

to optimally revise the budget in response Additionally, it would penalize profit centre

to changes in market and operational managers making strategic and timely

conditions. Additionally, an inventory decisions to change course to respond to

variable is added to the linear changing market conditions. The present paper

programming model to capture complements Yahya-Zadeh (2002) by

management’s planned and actual incorporating inventory and cost of capacity

inventory decisions. variances to it.

The proposed framework further In the accounting literature, the concept of an

distinguishes between practical and ex post budget based on an optimized linear

budgeted capacity in each department program was introduced by Demski (1967).

and explicitly identifies the planned and Hulbert and Toy (1977) initiated a similar

unplanned changes in inventory levels discussion in the marketing literature. They

and in capacity utilization. Collectively, suggested using the ex post data, information

these modifications to traditional flexible available to marketing manager at the end of

budgeting and variance analysis enhance the budget period, for analysing marketing

their managerial and pedagogical variances. The ex post information enabled

applications. them to isolate the planning component of

marketing variance from its performance

component. Consequently, poor performance

Keywords: due to inadequate planning could be separated

from variances due to substandard

performance. Hulbert and Toy further

Inventory Variance Analysis introduced the concepts of market size

Linear Programming (LP) variance and market share variance. Market

Ex Ante Flexible Budgets share variance was treated as controllable,

Ex Post Flexible Budgets while market size variance was considered

Practical and Budgeted Capacity uncontrollable for marketing managers.

Hulbert and Toy’s study was extended by

several other studies in the marketing literature

*George Mason University (Weber, et al., 1997; Sharma and Achabal,

61

JAMAR Vol. 9 · No. 2· 2011

1982; Jaworski, 1988; Mitchell and Olsen, incorporate inventory variance and cost of

2003). unused capacity into traditional profit variance

analysis. The use of the linear programming

The incentive to overproduce under absorption method makes it possible to view annual

costing has been the subject of much debate in budgeting as an optimization exercise in the

management accounting. The incentive to context of multi-department and multi-product

overproduce under absorption costing and companies. In addition, it redefines flexible

thereby capitalize higher portions of fixed budget, as an ex post, instead of an ex ante,

manufacturing overhead has been well known. concept. In determining inventory and cost of

Overproducing inventory defers current capacity variances, the current study follows

manufacturing costs to future periods through the methodology of Balakrishnan and Sprinkle

inventory account. Interpreting fixed (2002). Additionally, it extends their study by

manufacturing overhead cost as “cost of integrating ex post flexible budget into their

capacity” implies that increased inventory is model.

equivalent to moving capacity costs into future

periods. Pedagogically, the present study offers a new

way of thinking about variances and capacity

Cooper and Kaplan (1992) argued that costing. Cost accounting textbooks (e.g.,

companies should specifically examine the Horngren, et al.) often present variances for

cost of resources supplied (i.e., cost of individual products, and individual

available capacity) and differentiate it from departments. Further, they tend to ignore

cost of resources (capacity) used. While inventory variance except in the discussion of

periodic financial statement reporting is based product costing. Budgeted capacity is

on cost of resources supplied, activity-based routinely used to determine fixed overhead

costing provides information of cost of rate and the significance of using practical

resources used. Cooper and Kaplan (1992) capacity in activity-based costing and in

argue that cost of unused capacity is useful for overhead variance analysis is downplayed or

managerial decisions and should be reported completely overlooked. Traditional textbooks

for each activity. They made a distinction provide limited coverage of the linear

between budgeted and practical capacity and programming tool in the discussion of short-

argued in favour of using practical capacity for term product-mix decisions. At the same time,

computation of activity rates in activity-based the present study extends the work of the

costing. Kaplan (1994) extended this idea. earlier studies by emphasizing the need for an

Kaplan suggested decomposing activity rates optimal budgeting concept and by integrating

to their committed (i.e., fixed) and flexible linear programming into the discussion of

(i.e., variable) components. He used these inventory and capacity cost variances.

rates to determine budgeted unused capacity

costs and capacity utilization variances for The practical value of present study stems

each activity and to integrate ABC and flexible from its ability to view variance analysis in the

budgeting. context of overall optimization decisions.

Management’s midyear decision to adjust

Balakrishnan and Sprinkle (2002) presented a production levels of different departments or

new framework for profit variance analysis products is discussed relative to overall profit

that specifically identified and reported the maximization decision. Consequently,

cost of planned unused capacity and the cost unplanned changes in production levels of a

of unplanned use of idle capacity. In addition, department, treated as unfavourable moves

they specifically determined inventory change under the traditional approach, may be treated

variance as an integral part of profit variance as a positive step by the framework proposed

computations. The key features of their in this study. Management may have to change

improved variance analysis framework was its production plans midway through the

using practical capacity for computing fixed budget period and cause “unfavourable”

overhead costs and introducing a flexible capacity variances in some departments.

budget that was adjusted for actual sales Unless such decisions are examined through

volume and budgeted changes in inventory. the lens of a global optimization plan, it would

be hard to make sense of recurring or shifting

The present study uses the linear programming changes in inventory and capacity variances.

framework, as in Yahya-Zadeh (2002), to By integrating variance analysis and profit

62

JAMAR Vol. 9 · No. 2· 2011

optimization decisions, the present study units of X and Y, respectively. Actual fixed

demonstrates an approach for improving overhead cost in Department 1 was $37,500

measurement and interpretation of inventory, and actual fixed overhead in Department 2 was

capacity, and profit variances. $30,000.

The present paper illustrates the new inventory Observe that in this example Department 1 is

and capacity variances using a numerical planned to operate at its full practical capacity

example. First, the limitations of textbook (5,000 hours), whereas Department 2 is

variance analysis in dealing with multi-product budgeted to operate under capacity (4,143 ×

and multi-department situations are discussed. 0.2 + 3,457 × 0.8 = 3,594). This feature is the

In subsequent sections, an improved outcome of optimizing production and

framework for computation of inventory and inventory plans using the linear programming

capacity variances and for evaluating method (see Table 5 for optimization

management’s production decisions is procedure). This feature enables the study to

presented. examine mid-year changes in actual or

budgeted production and sales levels

Hypothetical Example differently than under the traditional approach.

Specifically, it charts the consequences of

Consider a firm with two production market changes beyond limits foreseen in the

departments and two products, X and Y. The static budget. A brief review of Balakrishnan

firm’s production, price, and inventory and Sprinkle’s (2002) helps set the stage for

information are shown in Table 1. the description of our numerical example.

The static budget indicates that during the Traditional Approach to Flexible Budgeting

upcoming year the firm plans to sell 4,143 and

3,457 units of products X and Y, respectively. Table 2 (Panel A) presents alternative

Manufacturing one unit of product X requires computations of overhead rates using budgeted

0.96 labour hours in Department 1 and 0.24 and practical capacities. Panel B of Table 2

labour hours in Department 2. Product X has a determines unit product costs using an

budgeted selling price of $88 and a budgeted overhead rate based on budgeted capacity and

unit variable manufacturing cost of $66. Panel C calculates unit product costs using

Beginning inventory for Product X is 200 units practical capacity as the denominator. The

and the desired ending inventory is 414 units planned increase in the firm’s inventories

(set at 10% of budgeted sales volume for the (10% increase) implies the need to determine

current period). The corresponding quantities unit costs in the beginning inventory and the

and prices for product Y (Table 1) should be need to use a cost flow assumption. LIFO is

1

interpreted in a similar manner. The practical the assumed inventory flow . Also, observe

capacity of Departments 1 and 2, measured in that practical capacity is used in computation

labour hours, are 5,000 and 4,000 labour of unit costs in the beginning inventories (see

hours, respectively. The current year’s Table 2, Panel C).

budgeted capacity of Departments 1 and 2 are

5,000 and 3,594 hours, respectively. Table 3 demonstrates the traditional flexible

Departments 1 and 2, respectively, have budgeting approach applied to the current

budgeted fixed annual manufacturing example. Budgeted gross profit for the period

overhead costs of $35,000 and $25,875. is $100,791.

Budgeted (and actual) total demand for the

two products is 7,600 units. Buyers can easily

substitute one product for another because of

similarity of their features and functions.

By the end of the budget year, the firm had 1

sold 3,814 units of product X and 3,786 of These assumptions are consistent with

product Y at average prices of $86.50 and $75, Balakrishnan and Sprinkle (2002). The use of

respectively. Actual inventory levels increased practical capacity for determination of unit costs in

far beyond the budgeted levels to 572 and 568 the beginning inventory is for consistency and

comparability of Tables 3, 4, and 6.

63

JAMAR Vol. 9 · No. 2· 2011

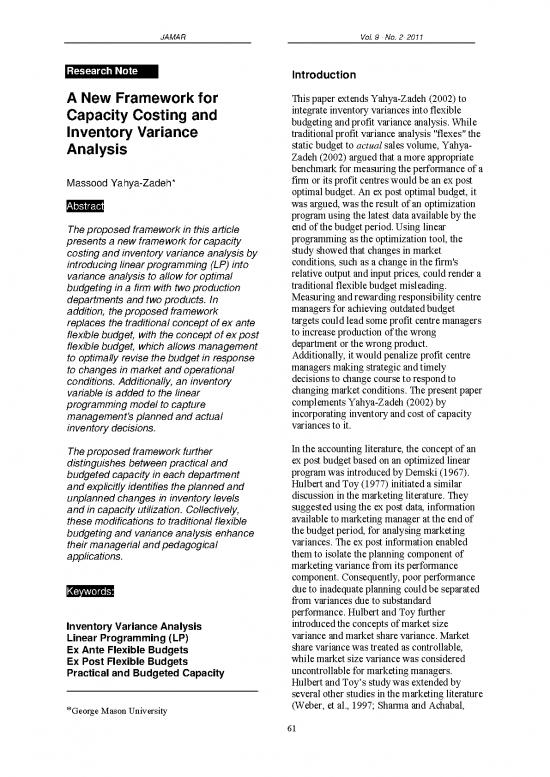

Table 1: Production and Inventory Levels Under Actual, Budgeted and Traditional Definition of Flexible

Budget

Actual (AR) Flexible Budget Static Budget (SB)

(based on actual (based on actual (based on ex ante

sales and sales and optimal sales and

Item inventory levels) inventory levels) inventory levels)

X Y X Y X Y

Sales volume a (units) 3,814 3,786 3,814 3,786 4,143 3,457

Unit price ($) $86.50 $75.00 $88.00 $74.00 $88.00 $74.00

Unit variable cost ($) 66.00 54.00 66.00 54.00 66.00 54.00

Unit contribution margin ($) 20.50 21.00 22.00 20.00 22.00 20.00

Beginning inventory (units) 200 400 200 400 200 400

Desired ending inventory (units) 572 568 572 568 414 346

Production volume (units) 4,186 3,954 4,186 3,954 4,357 3,403

Labour hours required in Dept. 1 per unit 0.96 0.24 0.96 0.24 0.96 0.24

Labour hours required in Dept. 2 per unit 0.2 0.8 0.2 0.8 0.2 0.8

Additional information:

Total market demand for products X and Y: 7,600 units

Department 1 Department 2

Current year budgeted capacity (labour hours) 5,000 3,594

Current year practical capacity (labour hours) 5,000 4,000

Last year’s practical capacity (labour hours) 5,000 4,000

Budgeted fixed manufacturing overhead (years 1, 2) $35,000 $25,875

Actual fixed manufacturing overhead—current year 37,500 30,000

Overhead rate based on budgeted capacity $7.00 $7.20

Overhead rate based on practical capacity 7.00 6.74

Product X Product Y

Budgeted increase in inventory level for current year 10% 10%

Actual increase in inventory level for current year 15% 15%

64

no reviews yet

Please Login to review.