241x Filetype XLSX File size 0.04 MB Source: agencymanagementinstitute.com

Sheet 1: Instructions

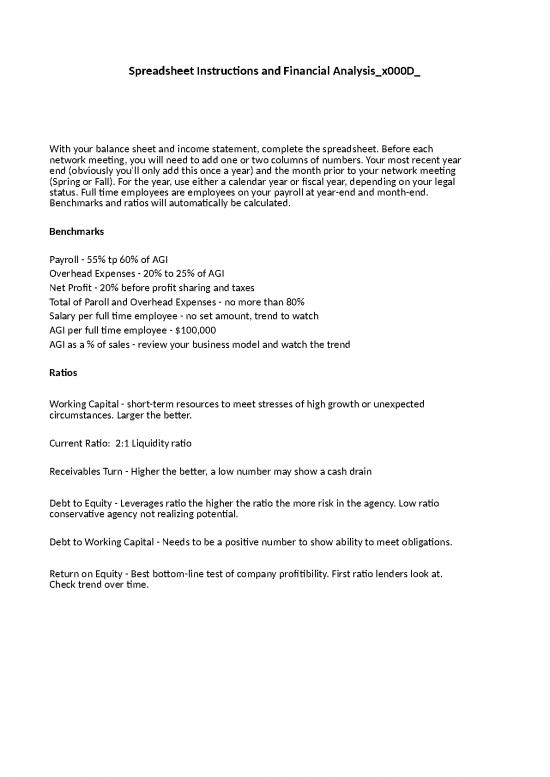

| With your balance sheet and income statement, complete the spreadsheet. Before each network meeting, you will need to add one or two columns of numbers. Your most recent year end (obviously you'll only add this once a year) and the month prior to your network meeting (Spring or Fall). For the year, use either a calendar year or fiscal year, depending on your legal status. Full time employees are employees on your payroll at year-end and month-end. Benchmarks and ratios will automatically be calculated. |

| Benchmarks |

| Payroll - 55% tp 60% of AGI |

| Overhead Expenses - 20% to 25% of AGI |

| Net Profit - 20% before profit sharing and taxes |

| Total of Paroll and Overhead Expenses - no more than 80% |

| Salary per full time employee - no set amount, trend to watch |

| AGI per full time employee - $100,000 |

| AGI as a % of sales - review your business model and watch the trend |

| Ratios |

| Working Capital - short-term resources to meet stresses of high growth or unexpected circumstances. Larger the better. |

| Current Ratio: 2:1 Liquidity ratio |

| Receivables Turn - Higher the better, a low number may show a cash drain |

| Debt to Equity - Leverages ratio the higher the ratio the more risk in the agency. Low ratio conservative agency not realizing potential. |

| Debt to Working Capital - Needs to be a positive number to show ability to meet obligations. |

| Return on Equity - Best bottom-line test of company profitibility. First ratio lenders look at. Check trend over time. |

| Sample Company | Data examples | Sample Company | Data examples | ||||||||||||||

| Previous Year | Previous | Current Year | Current | ||||||||||||||

| Goal | Year End | January | February | March | April | May | June | July | August | September | October | November | December | Goal | Year End | ||

| FROM YOUR INCOME STATEMENT | FROM YOUR INCOME STATEMENT | ||||||||||||||||

| Revenue/Billings | $2,000,000 | $1,900,000 | $200,000 | $205,000 | $200,000 | $200,000 | $205,000 | $200,000 | Revenue/Billings | $200,000 | $205,000 | $200,000 | $200,000 | $205,000 | $200,000 | $2,000,000 | $1,900,000 |

| Cost of Goods/Services | 600,000 | 810,000 | 77,000 | 78,000 | 77,000 | 77,000 | 78,000 | 77,000 | Cost of Goods/Services | 77,000 | 78,000 | 77,000 | 77,000 | 78,000 | 77,000 | 600,000 | 810,000 |

| Adjusted Gross Income | $1,400,000 | $1,090,000 | $123,000 | $127,000 | $123,000 | $123,000 | $127,000 | $123,000 | Adjusted Gross Income | $123,000 | $127,000 | $123,000 | $123,000 | $127,000 | $123,000 | $1,400,000 | $1,090,000 |

| Payroll / Salary Expense / Includes Taxes & Benefits | 770,000 | 770,000 | 66,000 | 65,000 | 66,000 | 66,000 | 66,000 | 65,000 | Payroll / Salary Expense / Includes Taxes & Benefits | 66,000 | 65,000 | 66,000 | 66,000 | 66,000 | 795,000 | 770,000 | 770,000 |

| Overhead Expense and Other Income/Expense | 325,000 | 300,000 | 26,000 | 29,000 | 26,000 | 26,000 | 29,000 | 30,000 | Overhead Expense and Other Income/Expense | 26,000 | 29,000 | 26,000 | 26,000 | 29,000 | 350,000 | 325,000 | 300,000 |

| Total Payroll and Overhead Expenses | $1,095,000 | 1,070,000 | 92,000 | 94,000 | $92,000 | 92,000 | 95,000 | $95,000 | Total Payroll and Overhead Expenses | 92,000 | 94,000 | $92,000 | 92,000 | 95,000 | $1,145,000 | $1,095,000 | 1,070,000 |

| Net Profit / Earnings Before Taxes (EBIT) AGI$ minus Expenses | $305,000 | $20,000 | $31,000 | $33,000 | $31,000 | $31,000 | $32,000 | $28,000 | Net Profit / Earnings Before Taxes (EBIT) AGI$ minus Expenses | $31,000 | $33,000 | $31,000 | $31,000 | $32,000 | $(1,022,000) | $305,000 | $20,000 |

| Full time employees (FTE) | 10 | 10 | 10 | 10 | 10 | 10 | 10 | 10 | Full time employees (FTE) | 10 | 10 | 10 | 10 | 10 | 10 | 10 | 10 |

| FROM YOUR BALANCE SHEET | FROM YOUR BALANCE SHEET | ||||||||||||||||

| Current Assets | 250,000 | 260,000 | 267,000 | 280,000 | 250,000 | 267,000 | 280,000 | 250,000 | Current Assets | 267,000 | 280,000 | 250,000 | 267,000 | 280,000 | 250,000 | 250,000 | 260,000 |

| Fixed Assets | 125,000 | 125,000 | 132,000 | 130,000 | 130,000 | 132,000 | 130,000 | 130,000 | Fixed Assets | 132,000 | 130,000 | 130,000 | 132,000 | 130,000 | 130,000 | 125,000 | 125,000 |

| Total Assets | $375,000 | $385,000 | $399,000 | $410,000 | $380,000 | $399,000 | $410,000 | $380,000 | Total Assets | $399,000 | $410,000 | $380,000 | $399,000 | $410,000 | $380,000 | $375,000 | $385,000 |

| Current Liabilities - (amount due in the next 12 months) | 100,000 | 100,000 | 102,000 | 105,000 | 100,000 | 102,000 | 105,000 | 100,000 | Current Liabilities - (amount due in the next 12 months) | 102,000 | 105,000 | 100,000 | 102,000 | 105,000 | 100,000 | 100,000 | 100,000 |

| Long-Term Liabilities - (amount due after the next 12 months | 120,000 | 120,000 | 100,000 | 115,000 | 112,000 | 100,000 | 108,000 | 105,000 | Long-Term Liabilities - (amount due after the next 12 months | 100,000 | 115,000 | 112,000 | 100,000 | 108,000 | 105,000 | 120,000 | 120,000 |

| Total Liabilities | $220,000 | $220,000 | $202,000 | $220,000 | $212,000 | $202,000 | $213,000 | $205,000 | Total Liabilities | $202,000 | $220,000 | $212,000 | $202,000 | $213,000 | $205,000 | $220,000 | $220,000 |

| Working Capital (Current Assets minus Current Liabilities) | $150,000 | $160,000 | $165,000 | $175,000 | $150,000 | $165,000 | $175,000 | $150,000 | Working Capital (Current Assets minus Current Liabilities) | $165,000 | $175,000 | $150,000 | $165,000 | $175,000 | $150,000 | $150,000 | $160,000 |

| Equity (Total Assets minus Total Liablities) | $155,000 | $165,000 | $197,000 | $190,000 | $168,000 | $197,000 | $197,000 | $175,000 | Equity (Total Assets minus Total Liablities) | $197,000 | $190,000 | $168,000 | $197,000 | $197,000 | $175,000 | $155,000 | $165,000 |

| Accounts Receivable | $105,000 | $100,000 | $85,000 | $100,000 | $102,000 | $85,000 | $90,000 | $105,000 | Accounts Receivable | $85,000 | $100,000 | $102,000 | $85,000 | $90,000 | $105,000 | $105,000 | $100,000 |

| BENCHMARKS | BENCHMARKS | ||||||||||||||||

| Payroll as a % of AGI$ | 55.0% | 70.6% | 53.7% | 51.2% | 53.7% | 53.7% | 52.0% | 52.8% | Payroll as a % of AGI$ | 53.7% | 51.2% | 53.7% | 53.7% | 52.0% | 646.3% | 55.0% | 70.6% |

| Overhead as a % of AGI$ | 23.2% | 27.5% | 21.1% | 22.8% | 21.1% | 21.1% | 22.8% | 24.4% | Overhead as a % of AGI$ | 21.1% | 22.8% | 21.1% | 21.1% | 22.8% | 284.6% | 23.2% | 27.5% |

| EBIT as a % of AGI$ | 21.8% | 1.8% | 25.2% | 26.0% | 25.2% | 25.2% | 25.2% | 22.8% | EBIT as a % of AGI$ | 25.2% | 26.0% | 25.2% | 25.2% | 25.2% | -830.9% | 21.8% | 1.8% |

| Salary Cost per FTE$ | $77,000 | $77,000 | $6,600 | $6,500 | $6,600 | $6,600 | $6,600 | $6,500 | Salary Cost per FTE$ | $6,600 | $6,500 | $6,600 | $6,600 | $6,600 | $79,500 | $77,000 | $77,000 |

| AGI per FTE$ | $140,000 | $109,000 | $12,300 | $12,700 | $12,300 | $12,300 | $12,700 | $12,300 | AGI per FTE$ | $12,300 | $12,700 | $12,300 | $12,300 | $12,700 | $12,300 | $140,000 | $109,000 |

| AGI as % of sales | 70.0% | 57.4% | 61.5% | 62.0% | 61.5% | 61.5% | 62.0% | 61.5% | AGI as % of sales | 61.5% | 62.0% | 61.5% | 61.5% | 62.0% | 61.5% | 70.0% | 57.4% |

| RATIOS | RATIOS | ||||||||||||||||

| Working Capital Ratio (Working Capital / AGI$) | 0.11 | 0.15 | 1.34 | 1.38 | 1.22 | 1.34 | 1.38 | 1.22 | Working Capital Ratio (Working Capital / AGI$) | 1.34 | 1.38 | 1.22 | 1.34 | 1.38 | 1.22 | 0.11 | 0.15 |

| Current Ratio (Current Assets divided by Current Liabilities) | 2.50 | 2.60 | 2.62 | 2.67 | 2.50 | 2.62 | 2.67 | 2.50 | Current Ratio (Current Assets divided by Current Liabilities) | 2.62 | 2.67 | 2.50 | 2.62 | 2.67 | 2.50 | 2.50 | 2.60 |

| Receivable turn | 19.05 | 19.00 | 2.35 | 2.05 | 1.96 | 2.35 | 2.28 | 1.90 | Receivable turn | 2.35 | 2.05 | 1.96 | 2.35 | 2.28 | 1.90 | 19.05 | 19.00 |

| Debt to Equity | 1.42 | 1.33 | 1.03 | 1.16 | 1.26 | 1.03 | 1.08 | 1.17 | Debt to Equity | 1.03 | 1.16 | 1.26 | 1.03 | 1.08 | 1.17 | 1.42 | 1.33 |

| Debt to Working Capital | 1.47 | 1.38 | 1.22 | 1.26 | 1.41 | 1.22 | 1.22 | 1.37 | Debt to Working Capital | 1.22 | 1.26 | 1.41 | 1.22 | 1.22 | 1.37 | 1.47 | 1.38 |

| Return on Equity | 1.97 | 0.12 | 0.16 | 0.17 | 0.18 | 0.16 | 0.16 | 0.16 | Return on Equity | 0.16 | 0.17 | 0.18 | 0.16 | 0.16 | (5.84) | 1.97 | 0.12 |

no reviews yet

Please Login to review.