296x Filetype XLSX File size 0.02 MB Source: www.frcs.org.fj

Sheet 1: P & L Taxi Business 1

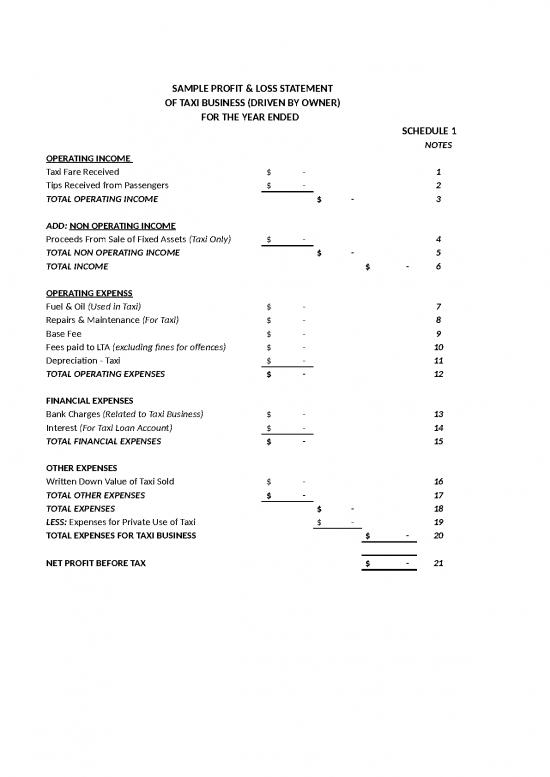

| SAMPLE PROFIT & LOSS STATEMENT | ||||

| OF TAXI BUSINESS (DRIVEN BY OWNER) | ||||

| FOR THE YEAR ENDED | ||||

| SCHEDULE 1 | ||||

| NOTES | ||||

| OPERATING INCOME | ||||

| Taxi Fare Received | $- | 1 | ||

| Tips Received from Passengers | $- | 2 | ||

| TOTAL OPERATING INCOME | $- | 3 | ||

| ADD: NON OPERATING INCOME | ||||

| Proceeds From Sale of Fixed Assets (Taxi Only) | $- | 4 | ||

| TOTAL NON OPERATING INCOME | $- | 5 | ||

| TOTAL INCOME | $- | 6 | ||

| OPERATING EXPENSS | ||||

| Fuel & Oil (Used in Taxi) | $- | 7 | ||

| Repairs & Maintenance (For Taxi) | $- | 8 | ||

| Base Fee | $- | 9 | ||

| Fees paid to LTA (excluding fines for offences) | $- | 10 | ||

| Depreciation - Taxi | $- | 11 | ||

| TOTAL OPERATING EXPENSES | $- | 12 | ||

| FINANCIAL EXPENSES | ||||

| Bank Charges (Related to Taxi Business) | $- | 13 | ||

| Interest (For Taxi Loan Account) | $- | 14 | ||

| TOTAL FINANCIAL EXPENSES | $- | 15 | ||

| OTHER EXPENSES | ||||

| Written Down Value of Taxi Sold | $- | 16 | ||

| TOTAL OTHER EXPENSES | $- | 17 | ||

| TOTAL EXPENSES | $- | 18 | ||

| LESS: Expenses for Private Use of Taxi | $- | 19 | ||

| TOTAL EXPENSES FOR TAXI BUSINESS | $- | 20 | ||

| NET PROFIT BEFORE TAX | $- | 21 | ||

| OTHER COMPONENTS OF PROFIT & LOSS STATEMENT NOT LISTED ABOVE CAN BE ADDED IF YOUR BUSINESS IS HAVING FINANCIAL TRANSACTIONS RELATED TO THESE COMPONENTS. | ||||

| SAMPLE PROFIT & LOSS STATEMENT | ||||

| OF TAXI BUSINESS (CONTRACTED TO DRIVER) | ||||

| FOR THE YEAR ENDED 31ST DECEMBER 2013 | ||||

| SCHEDULE 1 | ||||

| NOTES | ||||

| OPERATING INCOME | ||||

| Taxi Income | $- | 1 | ||

| ADD: NON OPERATING INCOME | ||||

| Proceeds From Sale of Fixed Assets (Taxi Only) | $- | 2 | ||

| TOTAL NON OPERATING INCOME | $- | 3 | ||

| TOTAL INCOME | $- | 4 | ||

| LESS: EXPENSES | ||||

| OPERATING EXPENSS | ||||

| Repairs & Maintenance (For Taxi) | $- | 5 | ||

| Base Fee | $- | 6 | ||

| Fees paid to LTA (excluding fines for offences) | $- | 7 | ||

| Depreciation - Taxi | $- | 8 | ||

| TOTAL OPERATING EXPENSES | $- | 9 | ||

| FINANCIAL EXPENSES | ||||

| Bank Charges (Related to Taxi Business) | $- | 10 | ||

| Interest (For Taxi Loan Account) | $- | 11 | ||

| TOTAL FINANCIAL EXPENSES | $- | 12 | ||

| OTHER EXPENSES | ||||

| Written Down Value of Taxi Sold | $- | 13 | ||

| TOTAL OTHER EXPENSES | $- | 14 | ||

| TOTAL EXPENSES | $- | 15 | ||

| LESS: Expenses for Private Use of Taxi | $- | 16 | ||

| TOTAL EXPENSES FOR TAXI BUSINESS | $- | 17 | ||

| NET PROFIT BEFORE TAX | $- | 18 | ||

| OTHER COMPONENTS OF PROFIT & LOSS STATEMENT NOT LISTED ABOVE CAN BE ADDED IF YOUR BUSINESS IS HAVING FINANCIAL TRANSACTIONS RELATED TO THESE COMPONENTS. | ||||

| SAMPLE BALANCE SHEET | |||||

| OF TAXI BUSINESS | |||||

| AS AT 31ST DECEMBER 2013 | |||||

| SCHEDULE 2 | |||||

| NOTES | |||||

| ASSETS | |||||

| CURRENT ASSETS | |||||

| Cash at Bank | $- | 1 | |||

| Cash on Hand | $- | 2 | |||

| Debtors | $- | 3 | |||

| Insurance In Advance | $- | 4 | |||

| TOTAL CURRENT ASSETS | $- | 5 | |||

| FIXED ASSETS | |||||

| TAXI (at Cost) | $- | 6 | |||

| Less: Accumulated Depreciation | $- | 7 | |||

| Written Down Value | $- | 8 | |||

| Land (Owned by you) | $- | 9 | |||

| Building (at Prime Cost) | $- | 10 | |||

| Less: Accumulated Depreciation | $- | 11 | |||

| Written Down Value | $- | 12 | |||

| Motor Vehicle (at cost) | $- | 13 | |||

| Less: Accumulated Depreciation | $- | 14 | |||

| Written Down Value | $- | 15 | |||

| TOTAL FIXED ASSETS | $- | 16 | |||

| TOTAL ASSETS | $- | 17 | |||

| LIABILITIES | |||||

| CURRENT LIABILITIES | |||||

| Creditors | $- | 18 | |||

| TOTAL CURRENT LIABILITIES | $- | 19 | |||

| LONG TERM LIABILTIES | |||||

| Loan Payable | $- | 20 | |||

| Taxi Loan Payable | $- | 21 | |||

| TOTAL LONG TERM LIABILITIES | $- | 22 | |||

| TOTAL LIABILTIES | $- | 23 | |||

| NET ASSETS (Total Assets less Total Liabilities) | $- | 24 | |||

| Equity | |||||

| Beginning Capital | $- | 25 | |||

| ADD: Net Profit After Tax for the Year | $- | 26 | |||

| $- | 27 | ||||

| LESS: Drawings | $- | 28 | |||

| CLOSING EQUITY | $- | 29 | |||

| OTHER COMPONENTS OF BALANCE SHEET NOT LISTED ABOVE CAN BE ADDED IF YOUR BUSINESS IS HAVING FINANCIAL TRANSACTIONS RELATED TO THESE COMPONENTS. | |||||

no reviews yet

Please Login to review.