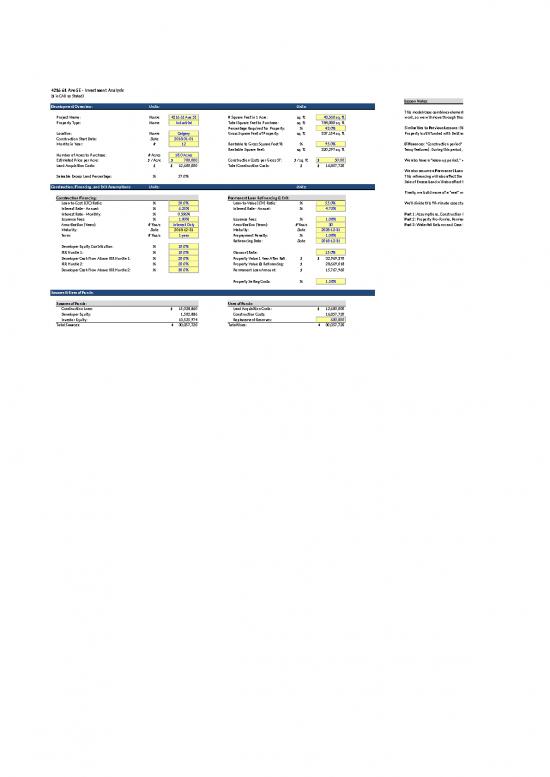

| 4216 61 Ave SE - Investment Analysis |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ in CAD as Stated) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lesson Notes: |

|

|

|

|

|

|

|

|

|

| Development Overview: |

|

Units: |

|

|

|

|

Units: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

This model/case combines elements of the previous two and expands on them. We've already explained how leases, Vacancies, Expense Reimbursements, etc. |

|

|

|

|

|

|

|

|

|

|

Project Name: |

Name |

4216 61 Ave SE |

|

# Square Feet in 1 Acre: |

|

sq. ft. |

43,560 sq. ft. |

|

|

work, so we will move through those parts of it quite quickly. |

|

|

|

|

|

|

|

|

|

|

Property Type: |

Name |

Industrial |

|

Total Square Feet to Purchase: |

|

sq. ft. |

784,080 sq. ft. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Percentage Required for Property: |

|

% |

43.0% |

|

|

Similarities to Previous Lessons: Still calculating revenue and expenses on a lease-by-lease basis, and still calculating IRR and multiples to different groups. |

|

|

|

|

|

|

|

|

|

|

Location: |

Name |

Calgary |

|

Gross Square Feet of Property: |

|

sq. ft. |

337,154 sq. ft. |

|

|

Property is still funded with Debt and Equity, and we still sell the entire property at the end. |

|

|

|

|

|

|

|

|

|

|

Construction Start Date: |

Date |

2018-01-01 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Months in Year: |

# |

12 |

|

Rentable to Gross Square Feet %: |

|

% |

95.0% |

|

|

Differences: "Construction period" of 1 year where the property is developed (industrial properties take little time - just 1-story warehouses with few frills or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rentable Square Feet: |

|

sq. ft. |

320,297 sq. ft. |

|

|

fancy features). During this period, both Debt and Equity are used as they are needed - not issued all at once! |

|

|

|

|

|

|

|

|

|

|

Number of Acres to Purchase: |

# Acres |

18.0 Acres |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Estimated Price per Acre: |

$ / Acre |

$700,000 |

|

Construction Costs per Gross SF: |

|

$ / sq. ft. |

$50.00 |

|

|

We also have a "lease-up period," where the new tenants start their leases at this brand-new building - some differences on the Pro-Forma. |

|

|

|

|

|

|

|

|

|

|

Land Acquisition Costs: |

$ |

$12,600,000 |

|

Total Construction Costs: |

|

$ |

$16,857,720 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

We also assume a Permanent Loan to refinance the Construction Loan, which is what happens in real life when the property stabilizes. |

|

|

|

|

|

|

|

|

|

|

Saleable Excess Land Percentage: |

% |

57.0% |

|

|

|

|

|

|

|

This refinancing will also affect the equity IRR because the property's value will change over time! |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sale of Excess Land will also affect the equity IRR - if we buy land but don't use it, we can sell it to someone else. |

|

|

|

|

|

|

|

|

|

| Construction, Financing, and Exit Assumptions: |

|

Units: |

|

|

|

|

Units: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Finally, we build more of a "real" waterfall schedule here, with multiple tiers and cash flow splits based on project-level returns. |

|

|

|

|

|

|

|

|

|

|

Construction Financing: |

|

|

|

Permanent Loan Refinancing & Exit: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loan-to-Cost (LTC) Ratio: |

% |

50.0% |

|

Loan-to-Value (LTV) Ratio: |

|

% |

55.0% |

|

|

We'll divide this 90-minute case study into 3 parts of roughly 20-30 minutes each and look at different aspects in each part. |

|

|

|

|

|

|

|

|

|

|

Interest Rate - Annual: |

% |

6.25% |

|

Interest Rate - Annual: |

|

% |

4.75% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Rate - Monthly: |

% |

0.506% |

|

|

|

|

|

|

|

Part 1: Assumptions, Construction Phase, and Tenant Rent and Expenses |

|

|

|

|

|

|

|

|

|

|

Issuance Fees: |

% |

1.00% |

|

Issuance Fees: |

|

% |

1.00% |

|

|

Part 2: Property Pro-Forma, Permanent Loan Refinancing, Excess Land Sale, and Equity Returns |

|

|

|

|

|

|

|

|

|

|

Amortization (Years): |

# Years |

Interest Only |

|

Amortization (Years): |

|

# Years |

30 |

|

|

Part 3: Waterfall Returns and Case Study Answers |

|

|

|

|

|

|

|

|

|

|

Maturity: |

Date |

2018-12-31 |

|

Maturity: |

|

Date |

2028-12-31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Term: |

# Years |

1 year |

|

Prepayment Penalty: |

|

% |

1.00% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Refinancing Date: |

|

Date |

2018-12-31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Developer Equity Contribution: |

% |

10.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IRR Hurdle 1: |

% |

10.0% |

|

Discount Rate: |

|

|

BIWS:

Based on sponsor's targeted unleveraged IRR for new developments.

15.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Developer Cash Flow Above IRR Hurdle 1: |

% |

20.0% |

|

Property Value 1 Year After Refi.: |

|

$ |

BIWS:

Using the Year 2 number because Year 1 includes Absorption & Turnover Vacancy, and 30% of the space is vacant in Year 1.

$32,969,370 |

|

|

|

|

|

|

|

|

|

|

|

|

|

IRR Hurdle 2: |

% |

20.0% |

|

Property Value @ Refinancing: |

|

$ |

BIWS:

Discounting to its value at the end of the Construction Year, i.e. one year back.

28,669,018 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Developer Cash Flow Above IRR Hurdle 2: |

% |

30.0% |

|

Permanent Loan Amount: |

|

$ |

15,767,960 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property Selling Costs: |

|

% |

1.50% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sources & Uses of Funds: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sources of Funds: |

|

|

|

Uses of Funds: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Construction Loan: |

|

$15,028,860 |

|

Land Acquisition Costs: |

|

|

$12,600,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Developer Equity: |

|

1,502,886 |

|

Construction Costs: |

|

|

16,857,720 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Investor Equity: |

|

13,525,974 |

|

Replacement Reserves: |

|

|

600,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Sources: |

|

$30,057,720 |

|

Total Uses: |

|

|

$30,057,720 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Construction: |

Operational Years: |

Stabilized: |

|

|

|

|

|

|

|

|

| Rent Roll & Operating Assumptions: |

|

Units: |

|

FY18 |

FY19 |

FY20 |

FY21 |

FY22 |

FY23 |

FY24 |

FY25 |

FY26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property-Wide Operating Assumptions: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses & Taxes per SF per Year: |

$ / sq. ft. / Yr |

2.35 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses & Taxes Annual Growth Rate: |

% |

3.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Property Management Fees % EGI: |

% |

3.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Replacement Reserves per SF per Year: |

$ / sq. ft. / Yr |

$0.30 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Replacement Reserve Growth Rate: |

% |

3.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

New Lease Term (Years): |

# Years |

5 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Renewal Probability: |

% |

60.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# Months of Downtime for Non-Renewal: |

# |

6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Free Rent and Capital Costs: |

|

New: |

Renewal: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

# Months of Free Rent: |

# |

4 |

2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tenant Improvements (TIs) per RSF: |

$ / sq. ft. / Yr |

$1.50 |

1.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leasing Commissions (LCs) % Total Lease Value: |

% |

3.0% |

1.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tenant #1 - Triple Net (NNN) Lease: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% Rentable Square Feet Occupied: |

% |

65.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rentable Square Feet Occupied: |

sq. ft. |

208,193 sq. ft. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease Start Date: |

Date |

2018-12-31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease Expiration Date: |

Date |

2022-12-31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Baseline Rent per Square Foot: |

$ / sq. ft. / Yr |

|

|

$7.50 |

$7.73 |

$7.96 |

$8.20 |

$8.44 |

$8.69 |

$8.96 |

$9.22 |

$9.50 |

|

|

|

|

|

|

|

|

Rental Growth Rate: |

% |

|

|

|

3.0% |

3.0% |

3.0% |

3.0% |

3.0% |

3.0% |

3.0% |

3.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(+) Base Rental Income: |

$ |

|

|

$1,561,446 |

$1,608,290 |

$1,656,538 |

$1,706,235 |

$1,757,422 |

$1,810,144 |

$1,864,449 |

$1,920,382 |

$1,977,993 |

|

|

|

|

|

|

|

|

(-) Absorption & Turnover Vacancy: |

$ |

|

|

BIWS:

Not counting anything here because the tenant moves in as of January 1 of this year.

- |

- |

- |

- |

(351,484) |

- |

- |

- |

|

|

|

|

|

|

|

|

|

(-) Concessions & Free Rent: |

$ |

|

|

(520,482) |

- |

- |

- |

(410,065) |

- |

- |

- |

|

|

|

|

|

|

|

|

|

(-) Tenant Improvements (TIs): |

$ |

|

|

(312,289) |

- |

- |

- |

(249,831) |

- |

- |

- |

|

|

|

|

|

|

|

|

|

(-) Leasing Commissions (LCs): |

$ |

|

|

(195,975) |

- |

- |

- |

(167,947) |

- |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(+) Expense Reimbursements: |

$ |

|

|

489,253 |

503,931 |

519,049 |

534,620 |

440,527 |

567,179 |

584,194 |

601,720 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tenant #2 - Triple Net (NNN) Lease: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% Rentable Square Feet Occupied: |

% |

30.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Rentable Square Feet Occupied: |

sq. ft. |

96,089 sq. ft. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease Start Date: |

Date |

2019-12-31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease Expiration Date: |

Date |

2023-12-31 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Baseline Rent per Square Foot: |

$ / sq. ft. / Yr |

|

|

$8.00 |

$8.24 |

$8.49 |

$8.74 |

$9.00 |

$9.27 |

$9.55 |

$9.84 |

$10.13 |

$10.44 |

|

|

|

|

|

|

|

Rental Growth Rate: |

% |

|

|

|

3.0% |

3.0% |

3.0% |

3.0% |

3.0% |

3.0% |

3.0% |

3.0% |

3.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(+) Base Rental Income: |

$ |

|

|

$768,712 |

$791,773 |

$815,527 |

$839,992 |

$865,192 |

$891,148 |

$917,882 |

$945,419 |

$973,781 |

$1,002,995 |

|

|

|

|

|

|

|

(-) Absorption & Turnover Vacancy: |

$ |

|

|

BIWS:

It takes a year to find the tenant, so we're deducting the entire Base Rental Income here.

(768,712) |

- |

- |

- |

- |

(178,230) |

- |

- |

|

|

|

|

|

|

|

|

|

(-) Concessions & Free Rent: |

$ |

|

|

- |

(263,924) |

- |

- |

- |

(207,935) |

- |

- |

|

|

|

|

|

|

|

|

|

(-) Tenant Improvements (TIs): |

$ |

|

|

- |

(144,134) |

- |

- |

- |

(115,307) |

- |

- |

|

|

|

|

|

|

|

|

|

(-) Leasing Commissions (LCs): |

$ |

|

|

- |

(99,375) |

- |

- |

- |

(85,162) |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(+) Expense Reimbursements: |

$ |

|

|

BIWS:

No tenant move-in yet, so no expense reimbursements.

- |

232,583 |

239,561 |

246,748 |

254,150 |

209,420 |

269,628 |

277,717 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual Capital Costs: |

$ |

|

|

(508,265) |

(243,508) |

- |

- |

(417,778) |

(200,469) |

- |

- |

|

|

|

|

|

|

|

|

|

Replacement Reserve Amount: |

$ |

|

600,000 |

187,824 |

43,288 |

145,229 |

250,228 |

- |

- |

114,735 |

232,913 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Numerical Year: |

Year |

|

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

2026 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Construction: |

Operational Years: |

Stabilized: |

|

|

|

|

|

|

|

|

| Property Pro-Forma: |

|

Units: |

|

FY18 |

FY19 |

FY20 |

FY21 |

FY22 |

FY23 |

FY24 |

FY25 |

FY26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(+) Base Rental Income: |

$ |

|

|

$2,450,270 |

$2,523,778 |

$2,599,491 |

$2,677,476 |

$2,757,800 |

$2,840,534 |

$2,925,750 |

$3,013,523 |

|

|

|

|

|

|

|

|

|

(-) Absorption & Turnover Vacancy: |

$ |

|

|

(768,712) |

- |

- |

- |

(351,484) |

(178,230) |

- |

- |

|

|

|

|

|

|

|

|

|

(-) Concessions & Free Rent: |

$ |

|

|

(520,482) |

(263,924) |

- |

- |

(410,065) |

(207,935) |

- |

- |

|

|

|

|

|

|

|

|

|

(+) Expense Reimbursements: |

$ |

|

|

489,253 |

736,514 |

758,610 |

781,368 |

694,677 |

776,598 |

853,822 |

879,436 |

|

|

|

|

|

|

|

|

|

Potential Gross Revenue: |

$ |

|

|

1,650,329 |

2,996,367 |

3,358,101 |

3,458,844 |

2,690,928 |

3,230,968 |

3,779,572 |

3,892,959 |

|

|

|

|

|

|

|

|

|

(-) General Vacancy: |

$ |

|

|

(120,111) |

(123,715) |

(127,426) |

(131,249) |

(135,186) |

(139,242) |

(143,419) |

(147,722) |

|

|

|

|

|

|

|

|

|

Effective Gross Income (EGI): |

$ |

|

|

1,530,217 |

2,872,653 |

3,230,675 |

3,327,595 |

2,555,742 |

3,091,726 |

3,636,153 |

3,745,237 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(-) Recoverable Expenses: |

$ |

|

|

(752,697) |

(775,278) |

(798,536) |

(822,493) |

(847,167) |

(872,582) |

(898,760) |

(925,723) |

|

|

|

|

|

|

|

|

|

(-) Management Fee: |

$ |

|

|

(45,907) |

(86,180) |

(96,920) |

(99,828) |

(76,672) |

(92,752) |

(109,085) |

(112,357) |

|

|

|

|

|

|

|

|

|

(-) CapEx, TI, and LC Reserves: |

$ |

|

|

(96,089) |

(98,972) |

(101,941) |

(104,999) |

(108,149) |

(111,393) |

(114,735) |

(118,177) |

|

|

|

|

|

|

|

|

|

Total Operating Expenses: |

$ |

|

|

(894,693) |

(960,429) |

(997,398) |

(1,027,319) |

(1,031,989) |

(1,076,728) |

(1,122,580) |

(1,156,257) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Operating Income (NOI): |

$ |

|

|

635,525 |

1,912,223 |

2,233,277 |

2,300,275 |

1,523,753 |

2,014,999 |

2,513,573 |

2,588,980 |

|

|

|

|

|

|

|

|

|

NOI Margin: |

% |

|

|

41.5% |

66.6% |

69.1% |

69.1% |

59.6% |

65.2% |

69.1% |

69.1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(-) CapEx, TIs, and LCs: |

$ |

|

|

(508,265) |

(243,508) |

- |

- |

(417,778) |

(200,469) |

- |

- |

|

|

|

|

|

|

|

|

|

(+) Capital Costs Paid from Reserves: |

$ |

|

|

508,265 |

243,508 |

- |

- |

358,377 |

111,393 |

- |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Net Operating Income: |

$ |

|

|

635,525 |

1,912,223 |

2,233,277 |

2,300,275 |

1,464,352 |

1,925,923 |

2,513,573 |

2,588,980 |

|

|

|

|

|

|

|

|

|

Adjusted NOI Margin: |

% |

|

|

41.5% |

66.6% |

69.1% |

69.1% |

57.3% |

62.3% |

69.1% |

69.1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(-) Interest Expense on Permanent Loan: |

$ |

|

|

(748,978) |

(737,212) |

(724,887) |

(711,977) |

(698,453) |

(684,287) |

(669,448) |

|

|

|

|

|

|

|

|

|

|

(-) Permanent Loan Principal Repayment: |

$ |

|

|

(247,706) |

(259,472) |

(271,797) |

(284,707) |

(298,231) |

(312,397) |

(327,236) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flow to Equity Investors: |

$ |

|

|

(361,159) |

915,539 |

1,236,593 |

1,303,591 |

467,667 |

929,239 |

1,516,889 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ending Permanent Loan Balance: |

$ |

|

15,767,960 |

15,520,254 |

15,260,782 |

14,988,985 |

14,704,277 |

14,406,046 |

14,093,649 |

13,766,414 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt Yield: |

% |

|

|

4.0% |

12.1% |

14.2% |

14.6% |

9.7% |

12.8% |

15.9% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest Coverage Ratio - NOI: |

x |

|

|

0.85 x |

2.59 x |

3.08 x |

3.23 x |

2.18 x |

2.94 x |

3.75 x |

|

|

|

|

|

|

|

|

|

|

Interest Coverage Ratio - Adjusted NOI: |

x |

|

|

0.85 x |

2.59 x |

3.08 x |

3.23 x |

2.10 x |

2.81 x |

3.75 x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Debt Service Coverage Ratio (DSCR) - NOI: |

x |

|

|

0.64 x |

1.92 x |

2.24 x |

2.31 x |

1.53 x |

2.02 x |

2.52 x |

|

|

|

|

|

|

|

|

|

|

Debt Service Coverage Ratio (DSCR) - Adj. NOI: |

x |

|

|

0.64 x |

1.92 x |

2.24 x |

2.31 x |

1.47 x |

1.93 x |

2.52 x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Construction: |

Operational Years: |

Stabilized: |

|

|

|

|

|

|

|

|

| Returns to All Equity Investors: |

|

Units: |

|

FY18 |

FY19 |

FY20 |

FY21 |

FY22 |

FY23 |

FY24 |

FY25 |

FY26 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Value of Excess Land: |

$ |

$7,182,000 |

$7,397,460 |

$7,619,384 |

$7,847,965 |

$8,083,404 |

$8,325,906 |

$8,575,684 |

$8,832,954 |

$9,097,943 |

|

|

|

|

|

|

|

|

|

|

Annual Growth Rate in Land Value: |

% |

|

3.0% |

3.0% |

3.0% |

3.0% |

3.0% |

3.0% |

3.0% |

3.0% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Forward NOI: |

$ |

|

|

1,912,223 |

2,233,277 |

2,300,275 |

1,523,753 |

2,014,999 |

2,513,573 |

2,588,980 |

|

|

|

|

|

|

|

|

|

|

Applicable Cap Rate: |

% |

|

|

5.80% |

5.70% |

5.60% |

5.50% |

5.60% |

5.70% |

5.75% |

|

|

|

|

|

|

|

|

|

|

Implied Property Value: |

$ |

|

|

32,969,370 |

39,180,300 |

41,076,347 |

27,704,600 |

35,982,120 |

44,097,773 |

45,025,743 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(-) Equity Draws: |

$ |

|

(15,028,860) |

BIWS:

No equity draws after construction finishes.

- |

- |

- |

- |

- |

- |

- |

|

|

|

|

|

|

|

|

|

|

(+) Permanent Loan Issued: |

$ |

|

15,767,960 |

BIWS:

Only happens once.

- |

- |

- |

- |

- |

- |

- |

|

|

|

|

|

|

|

|

|

|

(-) Permanent Loan Financing Fees: |

$ |

|

(157,680) |

BIWS:

Only happens once.

- |

- |

- |

- |

- |

- |

- |

|

|

|

|

|

|

|

|

|

|

(-) Construction Loan Refinanced: |

$ |

|

(15,583,300) |

BIWS:

Only happens once.

- |

- |

- |

- |

- |

- |

- |

|

|

|

|

|

|

|

|

|

|

(+) Cash Flow to Equity Investors: |

$ |

|

- |

(361,159) |

915,539 |

1,236,593 |

1,303,591 |

467,667 |

929,239 |

1,516,889 |

|

|

|

|

|

|

|

|

|

|

(+) Proceeds from Sale of Excess Land: |

$ |

|

- |

- |

- |

- |

8,325,906 |

- |

- |

- |

|

|

|

|

|

|

|

|

|

|

(+) Proceeds from Sale of Property: |

$ |

|

- |

- |

- |

- |

- |

- |

- |

45,025,743 |

|

|

|

|

|

|

|

|

|

|

(-) Selling Costs: |

$ |

|

- |

- |

- |

- |

- |

- |

- |

(675,386) |

|

|

|

|

|

|

|

|

|

|

(-) Repayment of Permanent Loan: |

$ |

|

- |

- |

- |

- |

- |

- |

- |

(13,766,414) |

|

|

|

|

|

|

|

|

|

|

(-) Prepayment Penalty on Permanent Loan: |

$ |

|

- |

- |

- |

- |

- |

- |

- |

(137,664) |

|

|

|

|

|

|

|

|

|

|

Total Cash Flows to Equity Investors: |

$ |

|

(15,001,880) |

(361,159) |

915,539 |

1,236,593 |

9,629,498 |

467,667 |

929,239 |

31,963,169 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Internal Rate of Return (IRR): |

% |

|

20.2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Returns to Equity: |

$ |

|

44,807,525 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Invested Equity: |

$ |

|

15,028,860 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash-on-Cash Multiple: |

x |

|

3.0 x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual Yield on Initial Investment: |

% |

|

|

(2.4%) |

6.1% |

8.2% |

64.1% |

3.1% |

6.2% |

212.7% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Construction: |

Operational Years: |

Stabilized: |

|

|

|

|

|

|

|

|

| Waterfall Returns Schedule: |

|

Units: |

|

FY18 |

FY19 |

FY20 |

FY21 |

FY22 |

FY23 |

FY24 |

FY25 |

FY26 |

|

Lesson Notes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tier 1 IRR - Up to 10.0%: |

|

|

|

|

|

|

|

|

|

|

|

|

The setup is very similar to what we saw in the last case study - calculate how much we "should" earn in a given year based on the IRR hurdle |

|

|

|

|

|

|

|

Leveraged IRR to All Equity Investors: |

|

|

|

|

|

|

|

|

|

|

|

|

we're at, such as 10% in Level 1. Then, "repay" however much we can based on the Cash Flow to Equity Investors. |

|

|

|

|

|

|

|

Beginning Balance: |

|

|

|

(15,001,880) |

(16,863,228) |

(17,634,011) |

(18,160,819) |

(10,347,404) |

(10,914,477) |

(11,076,685) |

|

|

|

|

|

|

|

|

|

|

Returns Accrual: |

10.0% |

|

|

(1,500,188) |

(1,686,323) |

(1,763,401) |

(1,816,082) |

(1,034,740) |

(1,091,448) |

(1,107,668) |

|

|

And we keep splitting this differently depending on the level we're in - 90/10 initially, then 80/20, and then 70/30. |

|

|

|

|

|

|

|

Repayment: |

100.0% |

|

|

(361,159) |

915,539 |

1,236,593 |

9,629,498 |

467,667 |

929,239 |

12,184,353 |

|

|

|

|

|

|

|

|

|

|

Ending Balance: |

|

|

(15,001,880) |

(16,863,228) |

(17,634,011) |

(18,160,819) |

(10,347,404) |

(10,914,477) |

(11,076,685) |

- |

|

|

DIFFERENCES: We now have multiple tiers, and we're looking at the project-level IRR - not the leveraged IRR to just the LPs! There's no "right" or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

"wrong" way to set this up, just different ways. We're looking at a variation here. |

|

|

|

|

|

|

|

Limited Partners (LPs): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beginning Balance: |

|

|

|

(13,501,692) |

(15,176,905) |

(15,870,610) |

(16,344,737) |

(9,312,663) |

(9,823,029) |

(9,969,016) |

|

|

Also, you must be VERY careful with the Initial Equity Contributed. Not just equal to the Equity Draws! |

|

|

|

|

|

|

|

Returns Accrual: |

10.0% |

|

|

(1,350,169) |

(1,517,691) |

(1,587,061) |

(1,634,474) |

(931,266) |

(982,303) |

(996,902) |

|

|

|

|

|

|

|

|

|

|

Repayment: |

90.0% |

|

|

(325,044) |

823,985 |

1,112,934 |

8,666,548 |

420,901 |

836,315 |

10,965,918 |

|

|

The issue is that we assume a Construction Loan refinancing and Permanent Loan at the end of the Construction Year, so that changes things and |

|

|

|

|

|

|

|

Ending Balance: |

|

|

(13,501,692) |

(15,176,905) |

(15,870,610) |

(16,344,737) |

(9,312,663) |

(9,823,029) |

(9,969,016) |

- |

|

|

boosts the proceeds to equity investors. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Developer: |

|

|

|

|

|

|

|

|

|

|

|

|

So… when we look at the "Ending Balance," we need to factor that in. Assume a proportional 90/10 split since we have no other information. |

|

|

|

|

|

|

|

Beginning Balance: |

|

|

|

(1,500,188) |

(1,686,323) |

(1,763,401) |

(1,816,082) |

(1,034,740) |

(1,091,448) |

(1,107,668) |

|

|

|

|

|

|

|

|

|

|

Returns Accrual: |

10.0% |

|

|

(150,019) |

(168,632) |

(176,340) |

(181,608) |

(103,474) |

(109,145) |

(110,767) |

|

|

Cash Flow Available for Tier 2 Distribution: Cash Flow to Equity Investors (overall) minus Total Repayment in this tier. |

|

|

|

|

|

|

|

Repayment: |

10.0% |

|

|

(36,116) |

91,554 |

123,659 |

962,950 |

46,767 |

92,924 |

1,218,435 |

|

|

|

|

|

|

|

|

|

|

Ending Balance: |

|

|

(1,500,188) |

(1,686,323) |

(1,763,401) |

(1,816,082) |

(1,034,740) |

(1,091,448) |

(1,107,668) |

- |

|

|

Tier 2 is largely the same - we just calculate everything based on a 20% IRR instead. Don't bother to split the cash flows up at this stage since |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

it's easier just to calculate what the cash flows "should be" at this 20% IRR level first. |

|

|

|

|

|

|

|

Cash Flow Available for Tier 2 Distribution: |

|

|

|

- |

- |

- |

- |

- |

- |

19,778,815 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flow Available for Tier 3 Distribution: Cash Flow to Equity Investors (overall) minus Total Repayment in this tier. Do NOT have to subtract |

|

|

|

|

|

|

|

Tier 2 IRR - Up to 20.0%: |

|

|

|

|

|

|

|

|

|

|

|

|

the Tier 1 Distributions since Tier 2 included everything up to a 20% IRR. |

|

|

|

|

|

|

|

Leveraged IRR to All Equity Investors: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beginning Balance: |

|

|

|

(15,001,880) |

(18,363,416) |

(21,120,560) |

(24,108,079) |

(19,300,197) |

(22,692,569) |

(26,301,843) |

|

|

Waterfall Returns Distributions by Investor Group and IRR Tier: The only tricky part here is that we must get only the cash flows that correspond |

|

|

|

|

|

|

|

Returns Accrual: |

20.0% |

|

|

(3,000,376) |

(3,672,683) |

(4,224,112) |

(4,821,616) |

(3,860,039) |

(4,538,514) |

(5,260,369) |

|

|

to the Tier 2 IRR - so we take the Tier 3 Availability and subtract the Tier 2 Availability, and then multiply by the split percentage. |

|

|

|

|

|

|

|

Repayment: |

100.0% |

|

|

(361,159) |

915,539 |

1,236,593 |

9,629,498 |

467,667 |

929,239 |

31,562,212 |

|

|

|

|

|

|

|

|

|

|

Ending Balance: |

|

|

(15,001,880) |

(18,363,416) |

(21,120,560) |

(24,108,079) |

(19,300,197) |

(22,692,569) |

(26,301,843) |

- |

|

|

Tier 1 and Tier 3 are easy and exactly what you'd expect. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Limited Partners (LPs): |

|

|

|

|

|

|

|

|

|

|

|

|

Returns Analysis by Investor Group: Also fairly straightforward - just add together everything in the area above, and use the IRR function, or |

|

|

|

|

|

|

|

Beginning Balance: |

|

|

|

(13,501,692) |

(16,490,958) |

(19,056,719) |

(21,878,788) |

(18,550,947) |

(21,887,003) |

(25,521,012) |

|

|

calculate the multiple(s) manually, or calculate the annual yield. |

|

|

|

|

|

|

|

Returns Accrual: |

20.0% |

|

|

(2,700,338) |

(3,298,192) |

(3,811,344) |

(4,375,758) |

(3,710,189) |

(4,377,401) |

(5,104,202) |

|

|

|

|

|

|

|

|

|

|

Repayment: |

80.0% |

|

|

(288,928) |

732,431 |

989,274 |

7,703,598 |

374,134 |

743,391 |

25,570,535 |

|

|

Case Study Answers: |

|

|

|

|

|

|

|

Ending Balance: |

|

|

(13,501,692) |

(16,490,958) |

(19,056,719) |

(21,878,788) |

(18,550,947) |

(21,887,003) |

(25,521,012) |

(5,054,679) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

No, we would not do the deal with the current terms because the LP IRR is below 20%, and the excess land assumption in the beginning makes no |

|

|

|

|

|

|

|

Developer: |

|

|

|

|

|

|

|

|

|

|

|

|

sense to us. Issues with the Permanent Loan refinancing, waterfall structure, and lack of data on other scenario as well. |

|

|

|

|

|

|

|

Beginning Balance: |

|

|

|

(1,500,188) |

(1,872,458) |

(2,063,841) |

(2,229,291) |

(749,249) |

(805,566) |

(780,831) |

|

|

|

|

|

|

|

|

|

|

Returns Accrual: |

20.0% |

|

|

(300,038) |

(374,492) |

(412,768) |

(445,858) |

(149,850) |

(161,113) |

(156,166) |

|

|

Biggest issue with the Permanent Loan is Year 1 - we recommend pushing back the refinancing a year so that the property has truly "stabilized." |

|

|

|

|

|

|

|

Repayment: |

20.0% |

|

|

(72,232) |

183,108 |

247,319 |

1,925,900 |

93,533 |

185,848 |

936,997 |

|

|

Construction Loan repayment would be higher, but we would also be able to use a bigger Permanent Loan balance and possibly even push for |

|

|

|

|

|

|

|

Ending Balance: |

|

|

(1,500,188) |

(1,872,458) |

(2,063,841) |

(2,229,291) |

(749,249) |

(805,566) |

(780,831) |

- |

|

|

a higher LTV with different amortization/interest assumptions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash Flow Available for Tier 3 Distribution: |

|

|

|

- |

- |

- |

- |

- |

- |

400,957 |

|

|

Approximate IRRs - You can calculate both of these in Excel with XIRR or IRR. Different from the interest rates due to compounding and loan |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

fees for the Construction Loan, and Loan Fees/Prepayment Penalty/Early Repayment for the Permanent Loan. |

|

|

|

|

|

|

|

Waterfall Returns Distributions by Investor Group and IRR Tier: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Much bigger difference for the Construction Loan, which reflects reality - higher risk/potential reward and much shorter time frame. |

|

|

|

|

|

|

|

Tier 1 IRR - Up to 10.0%: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Limited Partners (LPs): |

90.0% |

|

|

(325,044) |

823,985 |

1,112,934 |

8,666,548 |

420,901 |

836,315 |

10,965,918 |

|

|

Lender would stress test this very heavily and look at cases where the Downtime between tenants goes up to 12 months, where the rent increases |

|

|

|

|

|

|

|

Developers: |

10.0% |

|

|

(36,116) |

91,554 |

123,659 |

962,950 |

46,767 |

92,924 |

1,218,435 |

|

|

are negative or much lower, where the renewal probabilities are lower, etc., and see just how bad things get under those assumptions. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tier 2 IRR - Up to 20.0%: |

|

|

|

|

|

|

|

|

|

|

|

|

"Cash Flow Armageddon" - Worst-case scenario analysis. Won't necessarily say "no" if the numbers look terrible in this case, but might change the |

|

|

|

|

|

|

|

Limited Partners (LPs): |

80.0% |

|

|

- |

- |

- |

- |

- |

- |

15,502,287 |

|

|

terms of the loan. |

|

|

|

|

|

|

|

Developers: |

20.0% |

|

|

- |

- |

- |

- |

- |

- |

3,875,572 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating assumptions seem realistic based on the market figures provided in the document - rent, free rent/TIs, and so on. But we question the value |

|

|

|

|

|

|

|

Tier 3 IRR - 20.0% or Above: |

|

|

|

|

|

|

|

|

|

|

|

|

of the excess land - why buy it if we're not going ot use it? We're also a bit skeptical of the Cap Rate trend and the General Vacancy number since 5% |

|

|

|

|

|

|

|

Limited Partners (LPs): |

70.0% |

|

|

- |

- |

- |

- |

- |

- |

280,670 |

|

|

is very low, even in Calgary. We also can't assess the construction costs, operating expenses, or property taxes. |

|

|

|

|

|

|

|

Developers: |

30.0% |

|

|

- |

- |

- |

- |

- |

- |

120,287 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

More time and resources - sensitivities and scenarios. What happens when the Cap Rate changes by 1-2% in absolute terms? What about when the |

|

|

|

|

|

|

|

Returns Analysis by Investor Group: |

|

|

|

|

|

|

|

|

|

|

|

|

Downtime Months change or when the TIs/LCs/rent changes? What happens if it takes more or less time to find tenants? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Limited Partners (LP) - Leveraged Returns: |

$ |

|

(13,501,692) |

(325,044) |

823,985 |

1,112,934 |

8,666,548 |

420,901 |

836,315 |

26,748,875 |

|

|

|

|

|

|

|

|

|

|

Internal Rate of Return (IRR): |

% |

|

19.3% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash-on-Cash Multiple: |

x |

|

2.8 x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual Yield on Initial Investment: |

% |

|

|

(2.4%) |

6.1% |

8.2% |

64.2% |

3.1% |

6.2% |

198.1% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Developers - Leveraged Returns: |

$ |

|

(1,500,188) |

(36,116) |

91,554 |

123,659 |

962,950 |

46,767 |

92,924 |

5,214,294 |

|

|

|

|

|

|

|

|

|

|

Internal Rate of Return (IRR): |

% |

|

26.6% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash-on-Cash Multiple: |

x |

|

4.3 x |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Annual Yield on Initial Investment: |

% |

|

|

(2.4%) |

6.1% |

8.2% |

64.2% |

3.1% |

6.2% |

347.6% |

|

|

|

|

|

|

|

|

|