231x Filetype XLSX File size 0.08 MB Source: www.oregon.gov

Sheet 1: Retirement

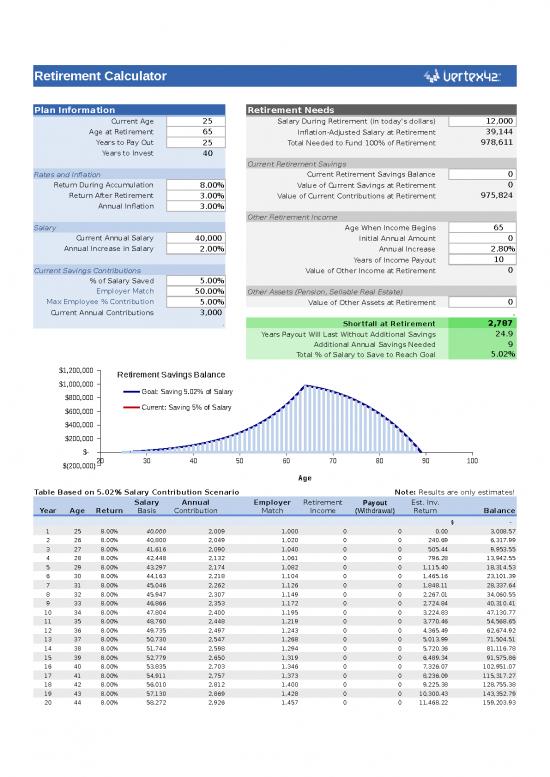

| Retirement Calculator | ||||||||||||

| ◄ Unhide rows 3-6 for a "Prepared By" header | ||||||||||||

| Plan Information | Retirement Needs | Retirement Calculator | ||||||||||

| Current Age | 25 |

|

12,000 | By Vertex42.com | ||||||||

| Age at Retirement | 65 | Inflation-Adjusted Salary at Retirement | 39,144 | © 2015-2019 Vertex42 LLC | ||||||||

|

|

25 |

|

978,611 | Like this? Visit the link above to give a +1 or Like. | ||||||||

|

|

40 | |||||||||||

| Current Retirement Savings | More Financial Calculators | |||||||||||

| Rates and Inflation |

|

0 | ||||||||||

|

|

8.00% |

|

0 | Notes | ||||||||

| Return After Retirement | 3.00% | Value of Current Contributions at Retirement | 975,824 | • Taxes and IRS Contribution Limits are NOT | ||||||||

|

|

3.00% | factored into any of these calculations. For example, | ||||||||||

| Other Retirement Income | this calculator does not take into account whether | |||||||||||

| Salary |

|

65 | contributions are pre-tax as in a traditional IRA or | |||||||||

| Current Annual Salary | 40,000 | Initial Annual Amount | 0 | post-tax as in a ROTH IRA. | ||||||||

| Annual Increase in Salary | 2.00% | Annual Increase | 2.80% | |||||||||

|

|

10 | • Mandatory disbursements and other regulations | ||||||||||

| Current Savings Contributions |

|

0 | are not accounted for. | |||||||||

|

|

5.00% | |||||||||||

|

|

50.00% | Other Assets (Pension, Sellable Real Estate) | • Results are only rough estimates, largely because | |||||||||

|

|

5.00% |

|

0 | of uncertainty in the rates of return, inflation, future | ||||||||

|

|

3,000 | . | salary, willpower to continue saving, unexpected life | |||||||||

| . |

|

2,787 | events, and other assumptions. | |||||||||

| Years Payout Will Last Without Additional Savings | 24.9 | |||||||||||

|

|

9 | • Interest compounds based on the number of | ||||||||||

|

|

5.02% | Payments per Year, which is 1 in this spreadsheet. | ||||||||||

| • This spreadsheet and its contents should not be | ||||||||||||

| construed as professional financial advice. It may not | ||||||||||||

| be suitable for your specific situation. | ||||||||||||

| Series 1 | Goal: Saving 5.02% of Salary | |||||||||||

| Series 2 | Current: Saving 5% of Salary | |||||||||||

|

|

1 | |||||||||||

|

|

1 | |||||||||||

| Table Based on 5.02% Salary Contribution Scenario | Note: Results are only estimates! | |||||||||||

| Year | Age |

|

|

|

|

|

(Withdrawal) |

|

|

|||

| $- | ||||||||||||

| 1 | 25 | 8.00% | 40,000 | 2,009 | 1,000 | 0 | 0 | 0.00 | 3,008.57 | |||

| 2 | 26 | 8.00% | 40,800 | 2,049 | 1,020 | 0 | 0 | 240.69 | 6,317.99 | |||

| 3 | 27 | 8.00% | 41,616 | 2,090 | 1,040 | 0 | 0 | 505.44 | 9,953.55 | |||

| 4 | 28 | 8.00% | 42,448 | 2,132 | 1,061 | 0 | 0 | 796.28 | 13,942.55 | |||

| 5 | 29 | 8.00% | 43,297 | 2,174 | 1,082 | 0 | 0 | 1,115.40 | 18,314.53 | |||

| 6 | 30 | 8.00% | 44,163 | 2,218 | 1,104 | 0 | 0 | 1,465.16 | 23,101.39 | |||

| 7 | 31 | 8.00% | 45,046 | 2,262 | 1,126 | 0 | 0 | 1,848.11 | 28,337.64 | |||

| 8 | 32 | 8.00% | 45,947 | 2,307 | 1,149 | 0 | 0 | 2,267.01 | 34,060.55 | |||

| 9 | 33 | 8.00% | 46,866 | 2,353 | 1,172 | 0 | 0 | 2,724.84 | 40,310.41 | |||

| 10 | 34 | 8.00% | 47,804 | 2,400 | 1,195 | 0 | 0 | 3,224.83 | 47,130.77 | |||

| 11 | 35 | 8.00% | 48,760 | 2,448 | 1,219 | 0 | 0 | 3,770.46 | 54,568.65 | |||

| 12 | 36 | 8.00% | 49,735 | 2,497 | 1,243 | 0 | 0 | 4,365.49 | 62,674.92 | |||

| 13 | 37 | 8.00% | 50,730 | 2,547 | 1,268 | 0 | 0 | 5,013.99 | 71,504.51 | |||

| 14 | 38 | 8.00% | 51,744 | 2,598 | 1,294 | 0 | 0 | 5,720.36 | 81,116.78 | |||

| 15 | 39 | 8.00% | 52,779 | 2,650 | 1,319 | 0 | 0 | 6,489.34 | 91,575.86 | |||

| 16 | 40 | 8.00% | 53,835 | 2,703 | 1,346 | 0 | 0 | 7,326.07 | 102,951.07 | |||

| 17 | 41 | 8.00% | 54,911 | 2,757 | 1,373 | 0 | 0 | 8,236.09 | 115,317.27 | |||

| 18 | 42 | 8.00% | 56,010 | 2,812 | 1,400 | 0 | 0 | 9,225.38 | 128,755.38 | |||

| 19 | 43 | 8.00% | 57,130 | 2,869 | 1,428 | 0 | 0 | 10,300.43 | 143,352.79 | |||

| 20 | 44 | 8.00% | 58,272 | 2,926 | 1,457 | 0 | 0 | 11,468.22 | 159,203.93 | |||

| 21 | 45 | 8.00% | 59,438 | 2,985 | 1,486 | 0 | 0 | 12,736.31 | 176,410.82 | |||

| 22 | 46 | 8.00% | 60,627 | 3,044 | 1,516 | 0 | 0 | 14,112.87 | 195,083.67 | |||

| 23 | 47 | 8.00% | 61,839 | 3,105 | 1,546 | 0 | 0 | 15,606.69 | 215,341.55 | |||

| 24 | 48 | 8.00% | 63,076 | 3,167 | 1,577 | 0 | 0 | 17,227.32 | 237,313.08 | |||

| 25 | 49 | 8.00% | 64,337 | 3,231 | 1,608 | 0 | 0 | 18,985.05 | 261,137.22 | |||

| 26 | 50 | 8.00% | 65,624 | 3,295 | 1,641 | 0 | 0 | 20,890.98 | 286,964.08 | |||

| 27 | 51 | 8.00% | 66,937 | 3,361 | 1,673 | 0 | 0 | 22,957.13 | 314,955.80 | |||

| 28 | 52 | 8.00% | 68,275 | 3,428 | 1,707 | 0 | 0 | 25,196.46 | 345,287.54 | |||

| 29 | 53 | 8.00% | 69,641 | 3,497 | 1,741 | 0 | 0 | 27,623.00 | 378,148.54 | |||

| 30 | 54 | 8.00% | 71,034 | 3,567 | 1,776 | 0 | 0 | 30,251.88 | 413,743.17 | |||

| 31 | 55 | 8.00% | 72,454 | 3,638 | 1,811 | 0 | 0 | 33,099.45 | 452,292.23 | |||

| 32 | 56 | 8.00% | 73,904 | 3,711 | 1,848 | 0 | 0 | 36,183.38 | 494,034.21 | |||

| 33 | 57 | 8.00% | 75,382 | 3,785 | 1,885 | 0 | 0 | 39,522.74 | 539,226.72 | |||

| 34 | 58 | 8.00% | 76,889 | 3,861 | 1,922 | 0 | 0 | 43,138.14 | 588,148.02 | |||

| 35 | 59 | 8.00% | 78,427 | 3,938 | 1,961 | 0 | 0 | 47,051.84 | 641,098.69 | |||

| 36 | 60 | 8.00% | 79,996 | 4,017 | 2,000 | 0 | 0 | 51,287.90 | 698,403.39 | |||

| 37 | 61 | 8.00% | 81,595 | 4,097 | 2,040 | 0 | 0 | 55,872.27 | 760,412.81 | |||

| 38 | 62 | 8.00% | 83,227 | 4,179 | 2,081 | 0 | 0 | 60,833.02 | 827,505.71 | |||

| 39 | 63 | 8.00% | 84,892 | 4,263 | 2,122 | 0 | 0 | 66,200.46 | 900,091.25 | |||

| 40 | 64 | 8.00% | 86,590 | 4,348 | 2,165 | 0 | 0 | 72,007.30 | 978,611.34 | |||

| 41 | 65 | 3.00% | 39,144 | 0 | 0 | 0 | 39,144 | 28,184.01 | 967,650.89 | |||

| 42 | 66 | 3.00% | 40,319 | 0 | 0 | 0 | 40,319 | 27,819.96 | 955,152.07 | |||

| 43 | 67 | 3.00% | 41,528 | 0 | 0 | 0 | 41,528 | 27,408.71 | 941,032.43 | |||

| 44 | 68 | 3.00% | 42,774 | 0 | 0 | 0 | 42,774 | 26,947.75 | 925,205.97 | |||

| 45 | 69 | 3.00% | 44,057 | 0 | 0 | 0 | 44,057 | 26,434.46 | 907,583.00 | |||

| 46 | 70 | 3.00% | 45,379 | 0 | 0 | 0 | 45,379 | 25,866.12 | 888,069.97 | |||

| 47 | 71 | 3.00% | 46,741 | 0 | 0 | 0 | 46,741 | 25,239.88 | 866,569.33 | |||

| 48 | 72 | 3.00% | 48,143 | 0 | 0 | 0 | 48,143 | 24,552.80 | 842,979.38 | |||

| 49 | 73 | 3.00% | 49,587 | 0 | 0 | 0 | 49,587 | 23,801.77 | 817,194.13 | |||

| 50 | 74 | 3.00% | 51,075 | 0 | 0 | 0 | 51,075 | 22,983.58 | 789,103.08 | |||

| 51 | 75 | 3.00% | 52,607 | 0 | 0 | 0 | 52,607 | 22,094.89 | 758,591.10 | |||

| 52 | 76 | 3.00% | 54,185 | 0 | 0 | 0 | 54,185 | 21,132.18 | 725,538.20 | |||

| 53 | 77 | 3.00% | 55,811 | 0 | 0 | 0 | 55,811 | 20,091.83 | 689,819.40 | |||

| 54 | 78 | 3.00% | 57,485 | 0 | 0 | 0 | 57,485 | 18,970.03 | 651,304.48 | |||

| 55 | 79 | 3.00% | 59,209 | 0 | 0 | 0 | 59,209 | 17,762.85 | 609,857.83 | |||

| 56 | 80 | 3.00% | 60,986 | 0 | 0 | 0 | 60,986 | 16,466.16 | 565,338.21 | |||

| 57 | 81 | 3.00% | 62,815 | 0 | 0 | 0 | 62,815 | 15,075.69 | 517,598.54 | |||

| 58 | 82 | 3.00% | 64,700 | 0 | 0 | 0 | 64,700 | 13,586.96 | 466,485.68 | |||

| 59 | 83 | 3.00% | 66,641 | 0 | 0 | 0 | 66,641 | 11,995.35 | 411,840.22 | |||

| 60 | 84 | 3.00% | 68,640 | 0 | 0 | 0 | 68,640 | 10,296.01 | 353,496.19 | |||

| 61 | 85 | 3.00% | 70,699 | 0 | 0 | 0 | 70,699 | 8,483.91 | 291,280.86 | |||

| 62 | 86 | 3.00% | 72,820 | 0 | 0 | 0 | 72,820 | 6,553.82 | 225,014.46 | |||

| 63 | 87 | 3.00% | 75,005 | 0 | 0 | 0 | 75,005 | 4,500.29 | 154,509.93 | |||

| 64 | 88 | 3.00% | 77,255 | 0 | 0 | 0 | 77,255 | 2,317.65 | 79,572.61 | |||

| 65 | 89 | 3.00% | 79,573 | 0 | 0 | 0 | 79,573 | 0.00 | 0.00 | |||

| #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | ||

| #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | ||

| #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | ||

| #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | ||

| #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | ||

| #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | ||

| #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | ||

| #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | ||

| #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | ||

| #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | ||

| Table Based on 5.00% Salary Contribution Scenario | Note: Results are only estimates! | |||||||||||

| Year | Age | Return | Salary Basis | Annual Contribution | Employer Match | Retirement Income | Payout (Withdrawal) |

Interest Earned |

Balance | |||

| $- | ||||||||||||

| 1 | 25 | 8.00% | 40,000 | 2,000 | 1,000 | 0 | 0 | 0.00 | 3,000.00 | |||

| 2 | 26 | 8.00% | 40,800 | 2,040 | 1,020 | 0 | 0 | 240.00 | 6,300.00 | |||

| 3 | 27 | 8.00% | 41,616 | 2,081 | 1,040 | 0 | 0 | 504.00 | 9,925.20 | |||

| 4 | 28 | 8.00% | 42,448 | 2,122 | 1,061 | 0 | 0 | 794.02 | 13,902.84 | |||

| 5 | 29 | 8.00% | 43,297 | 2,165 | 1,082 | 0 | 0 | 1,112.23 | 18,262.36 | |||

| 6 | 30 | 8.00% | 44,163 | 2,208 | 1,104 | 0 | 0 | 1,460.99 | 23,035.60 | |||

| 7 | 31 | 8.00% | 45,046 | 2,252 | 1,126 | 0 | 0 | 1,842.85 | 28,256.93 | |||

| 8 | 32 | 8.00% | 45,947 | 2,297 | 1,149 | 0 | 0 | 2,260.55 | 33,963.54 | |||

| 9 | 33 | 8.00% | 46,866 | 2,343 | 1,172 | 0 | 0 | 2,717.08 | 40,195.60 | |||

| 10 | 34 | 8.00% | 47,804 | 2,390 | 1,195 | 0 | 0 | 3,215.65 | 46,996.53 | |||

| 11 | 35 | 8.00% | 48,760 | 2,438 | 1,219 | 0 | 0 | 3,759.72 | 54,413.23 | |||

| 12 | 36 | 8.00% | 49,735 | 2,487 | 1,243 | 0 | 0 | 4,353.06 | 62,496.42 | |||

| 13 | 37 | 8.00% | 50,730 | 2,536 | 1,268 | 0 | 0 | 4,999.71 | 71,300.85 | |||

| 14 | 38 | 8.00% | 51,744 | 2,587 | 1,294 | 0 | 0 | 5,704.07 | 80,885.74 | |||

| 15 | 39 | 8.00% | 52,779 | 2,639 | 1,319 | 0 | 0 | 6,470.86 | 91,315.04 | |||

| 16 | 40 | 8.00% | 53,835 | 2,692 | 1,346 | 0 | 0 | 7,305.20 | 102,657.85 | |||

| 17 | 41 | 8.00% | 54,911 | 2,746 | 1,373 | 0 | 0 | 8,212.63 | 114,988.83 | |||

| 18 | 42 | 8.00% | 56,010 | 2,800 | 1,400 | 0 | 0 | 9,199.11 | 128,388.66 | |||

| 19 | 43 | 8.00% | 57,130 | 2,856 | 1,428 | 0 | 0 | 10,271.09 | 142,944.49 | |||

| 20 | 44 | 8.00% | 58,272 | 2,914 | 1,457 | 0 | 0 | 11,435.56 | 158,750.49 | |||

| 21 | 45 | 8.00% | 59,438 | 2,972 | 1,486 | 0 | 0 | 12,700.04 | 175,908.37 | |||

| 22 | 46 | 8.00% | 60,627 | 3,031 | 1,516 | 0 | 0 | 14,072.67 | 194,528.04 | |||

| 23 | 47 | 8.00% | 61,839 | 3,092 | 1,546 | 0 | 0 | 15,562.24 | 214,728.22 | |||

| 24 | 48 | 8.00% | 63,076 | 3,154 | 1,577 | 0 | 0 | 17,178.26 | 236,637.17 | |||

| 25 | 49 | 8.00% | 64,337 | 3,217 | 1,608 | 0 | 0 | 18,930.97 | 260,393.46 | |||

| 26 | 50 | 8.00% | 65,624 | 3,281 | 1,641 | 0 | 0 | 20,831.48 | 286,146.75 | |||

| 27 | 51 | 8.00% | 66,937 | 3,347 | 1,673 | 0 | 0 | 22,891.74 | 314,058.75 | |||

| 28 | 52 | 8.00% | 68,275 | 3,414 | 1,707 | 0 | 0 | 25,124.70 | 344,304.11 | |||

| 29 | 53 | 8.00% | 69,641 | 3,482 | 1,741 | 0 | 0 | 27,544.33 | 377,071.51 | |||

| 30 | 54 | 8.00% | 71,034 | 3,552 | 1,776 | 0 | 0 | 30,165.72 | 412,564.77 | |||

| 31 | 55 | 8.00% | 72,454 | 3,623 | 1,811 | 0 | 0 | 33,005.18 | 451,004.03 | |||

| 32 | 56 | 8.00% | 73,904 | 3,695 | 1,848 | 0 | 0 | 36,080.32 | 492,627.12 | |||

| 33 | 57 | 8.00% | 75,382 | 3,769 | 1,885 | 0 | 0 | 39,410.17 | 537,690.91 | |||

| 34 | 58 | 8.00% | 76,889 | 3,844 | 1,922 | 0 | 0 | 43,015.27 | 586,472.88 | |||

| 35 | 59 | 8.00% | 78,427 | 3,921 | 1,961 | 0 | 0 | 46,917.83 | 639,272.74 | |||

| 36 | 60 | 8.00% | 79,996 | 4,000 | 2,000 | 0 | 0 | 51,141.82 | 696,414.22 | |||

| 37 | 61 | 8.00% | 81,595 | 4,080 | 2,040 | 0 | 0 | 55,713.14 | 758,247.02 | |||

| 38 | 62 | 8.00% | 83,227 | 4,161 | 2,081 | 0 | 0 | 60,659.76 | 825,148.84 | |||

| 39 | 63 | 8.00% | 84,892 | 4,245 | 2,122 | 0 | 0 | 66,011.91 | 897,527.65 | |||

| 40 | 64 | 8.00% | 86,590 | 4,329 | 2,165 | 0 | 0 | 71,802.21 | 975,824.09 | |||

| 41 | 65 | 3.00% | 39,144 | 0 | 0 | 0 | 39,144 | 28,100.39 | 964,780.03 | |||

| 42 | 66 | 3.00% | 40,319 | 0 | 0 | 0 | 40,319 | 27,733.84 | 952,195.08 | |||

| 43 | 67 | 3.00% | 41,528 | 0 | 0 | 0 | 41,528 | 27,320.00 | 937,986.73 | |||

| 44 | 68 | 3.00% | 42,774 | 0 | 0 | 0 | 42,774 | 26,856.38 | 922,068.90 | |||

| 45 | 69 | 3.00% | 44,057 | 0 | 0 | 0 | 44,057 | 26,340.34 | 904,351.82 | |||

| 46 | 70 | 3.00% | 45,379 | 0 | 0 | 0 | 45,379 | 25,769.18 | 884,741.85 | |||

| 47 | 71 | 3.00% | 46,741 | 0 | 0 | 0 | 46,741 | 25,140.04 | 863,141.37 | |||

| 48 | 72 | 3.00% | 48,143 | 0 | 0 | 0 | 48,143 | 24,449.96 | 839,448.58 | |||

| 49 | 73 | 3.00% | 49,587 | 0 | 0 | 0 | 49,587 | 23,695.85 | 813,557.41 | |||

| 50 | 74 | 3.00% | 51,075 | 0 | 0 | 0 | 51,075 | 22,874.48 | 785,357.26 | |||

| 51 | 75 | 3.00% | 52,607 | 0 | 0 | 0 | 52,607 | 21,982.51 | 754,732.90 | |||

| 52 | 76 | 3.00% | 54,185 | 0 | 0 | 0 | 54,185 | 21,016.43 | 721,564.25 | |||

| 53 | 77 | 3.00% | 55,811 | 0 | 0 | 0 | 55,811 | 19,972.61 | 685,726.23 | |||

| 54 | 78 | 3.00% | 57,485 | 0 | 0 | 0 | 57,485 | 18,847.24 | 647,088.52 | |||

| 55 | 79 | 3.00% | 59,209 | 0 | 0 | 0 | 59,209 | 17,636.37 | 605,515.39 | |||

| 56 | 80 | 3.00% | 60,986 | 0 | 0 | 0 | 60,986 | 16,335.89 | 560,865.50 | |||

| 57 | 81 | 3.00% | 62,815 | 0 | 0 | 0 | 62,815 | 14,941.50 | 512,991.65 | |||

| 58 | 82 | 3.00% | 64,700 | 0 | 0 | 0 | 64,700 | 13,448.75 | 461,740.58 | |||

| 59 | 83 | 3.00% | 66,641 | 0 | 0 | 0 | 66,641 | 11,852.99 | 406,952.76 | |||

| 60 | 84 | 3.00% | 68,640 | 0 | 0 | 0 | 68,640 | 10,149.38 | 348,462.11 | |||

| 61 | 85 | 3.00% | 70,699 | 0 | 0 | 0 | 70,699 | 8,332.89 | 286,095.76 | |||

| 62 | 86 | 3.00% | 72,820 | 0 | 0 | 0 | 72,820 | 6,398.27 | 219,673.81 | |||

| 63 | 87 | 3.00% | 75,005 | 0 | 0 | 0 | 75,005 | 4,340.07 | 149,009.06 | |||

| 64 | 88 | 3.00% | 77,255 | 0 | 0 | 0 | 77,255 | 2,152.62 | 73,906.72 | |||

| 65 | 89 | 3.00% | 79,573 | 0 | 0 | 0 | 79,573 | -169.98 | -5,835.87 | |||

| #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | ||

| #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | ||

| #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | ||

| #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | ||

| #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | ||

| #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | ||

| #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | ||

| #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | ||

| #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | ||

| #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | #N/A | ||

| HELP | ||

| https://www.vertex42.com/Calculators/retirement-calculator.html | © 2015-2019 Vertex42 LLC | |

| About This Template | ||

| This calculator is designed to estimate how much of your salary you may need to contribute towards savings to meet your retirement goal. It was designed based on combining a 401(k) savings calculator with a retirement withdrawal calculator. | ||

| Caution: There are a large number of assumptions and estimations made by this calculator, so be careful how you use and interpret the results. For example, it does not take into account current debt, taxes, large future expenses or disasters, etc. | ||

| Due to the complexity of retirement planning, you may need to seek help from a certified professional to understand how a calculator like this works and its limitations. | ||

| Instructions | ||

| Only edit the cells with the light gray border. | ||

| Read the cell comments to learn more about some of the inputs and outputs. | ||

| Additional Help | ||

| The link at the top of this worksheet will take you to the web page on vertex42.com that talks about this template. | ||

| REFERENCES | ||

| SEE ALSO | Vertex42.com: Home Mortgage Calculator | |

| SEE ALSO | Vertex42.com: 401(k) Savings Calculator | |

| SEE ALSO | Vertex42.com: Retirement Withdrawal Calculator | |

| SEE ALSO | Vertex42.com: Personal Budget Spreadsheet | |

| TIPS | Vertex42.com: Spreadsheet Tips Workbook | |

no reviews yet

Please Login to review.