152x Filetype XLSX File size 0.18 MB Source: www.reca.ca

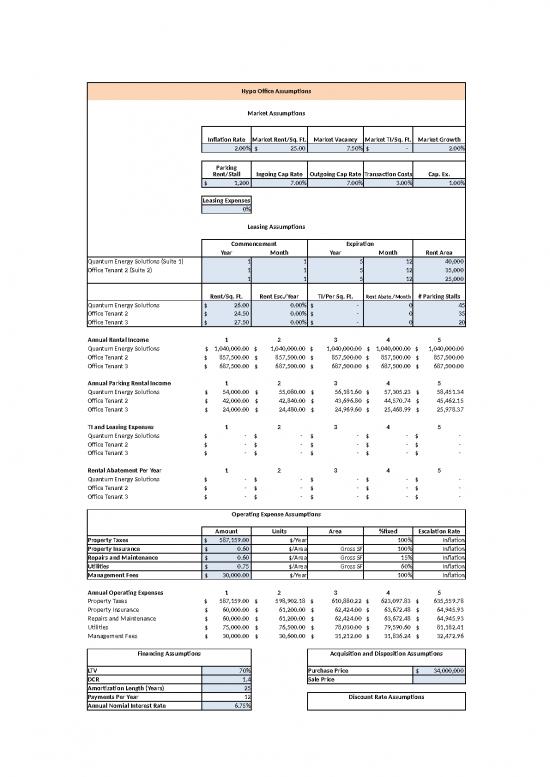

Sheet 1: Model Assumptions

| Hypo Office Assumptions | Hypo Office Model Summary | |||||||||||||||

| Market Assumptions | Property Summary | |||||||||||||||

| Inflation Rate | Market Rent/Sq. Ft. | Market Vacancy | Market TI/Sq. Ft. | Market Growth | ||||||||||||

| 2.00% | $25.00 | 7.50% | $- | 2.00% | Physical Summary | |||||||||||

| Parking Rent/Stall | Ingoing Cap Rate | Outgoing Cap Rate | Transaction Costs | Cap. Ex. | Property Type | Office | ||||||||||

| $1,200 | 7.00% | 7.00% | 3.00% | 1.00% | Gross Leaseable Area | 100,000 | ||||||||||

| # of Tenants | 3 | |||||||||||||||

| Leasing Expenses | # Parking Stalls | 100 | ||||||||||||||

| 0% | ||||||||||||||||

| Performance Summary | ||||||||||||||||

| Leasing Assumptions | ||||||||||||||||

| Stabilized Proforma NOI (Year 1) | $2,408,175 | |||||||||||||||

| Commencement | Expiration | Estimated Purchase Price | $34,000,000 | |||||||||||||

| Year | Month | Year | Month | Rent Area | Stabilized Proforma NOI (Year 6) | $2,711,996 | ||||||||||

| Quantum Energy Solutions (Suite 1) | 1 | 1 | 5 | 12 | 40,000 | Estimated Sale Price | $37,580,519 | |||||||||

| Office Tenant 2 (Suite 2) | 1 | 1 | 5 | 12 | 35,000 | Unleveraged IRR | 9.63% | |||||||||

| 1 | 1 | 5 | 12 | 25,000 | Unleveraged PV | $34,858,272 | ||||||||||

| Unleveraged NPV | $858,272 | |||||||||||||||

| Rent/Sq. Ft. | Rent Esc./Year | TI/Per Sq. Ft. | Rent Abate./Month | # Parking Stalls | Leveraged IRR | 12.96% | ||||||||||

| Quantum Energy Solutions | $26.00 | 0.00% | $- | 0 | 45 | Leveraged PV | $13,815,920 | |||||||||

| Office Tenant 2 | $24.50 | 0.00% | $- | 0 | 35 | Leveraged NPV | $322,007 | |||||||||

| Office Tenant 3 | $27.50 | 0.00% | $- | 0 | 20 | |||||||||||

| Annual Rental Income | 1 | 2 | 3 | 4 | 5 | |||||||||||

| Quantum Energy Solutions | $1,040,000.00 | $1,040,000.00 | $1,040,000.00 | $1,040,000.00 | $1,040,000.00 | Summary Ratios | 1 | 2 | 3 | 4 | 5 | |||||

| Office Tenant 2 | $857,500.00 | $857,500.00 | $857,500.00 | $857,500.00 | $857,500.00 | Unleveraged | ||||||||||

| Office Tenant 3 | $687,500.00 | $687,500.00 | $687,500.00 | $687,500.00 | $687,500.00 | ROE | 7.96% | 7.96% | 7.97% | 7.98% | 7.98% | |||||

| Annual Parking Rental Income | 1 | 2 | 3 | 4 | 5 | Leveraged | ||||||||||

| Quantum Energy Solutions | $54,000.00 | $55,080.00 | $56,181.60 | $57,305.23 | $58,451.34 | DCR | 1.57 | 1.57 | 1.58 | 1.58 | 1.58 | |||||

| Office Tenant 2 | $42,000.00 | $42,840.00 | $43,696.80 | $44,570.74 | $45,462.15 | ROE | 0.00% | 7.66% | 7.68% | 7.70% | 156.02% | |||||

| Office Tenant 3 | $24,000.00 | $24,480.00 | $24,969.60 | $25,468.99 | $25,978.37 | |||||||||||

| TI and Leasing Expenses | 1 | 2 | 3 | 4 | 5 | |||||||||||

| Quantum Energy Solutions | $- | $- | $- | $- | $- | |||||||||||

| Office Tenant 2 | $- | $- | $- | $- | $- | |||||||||||

| Office Tenant 3 | $- | $- | $- | $- | $- | |||||||||||

| Rental Abatement Per Year | 1 | 2 | 3 | 4 | 5 | |||||||||||

| Quantum Energy Solutions | $- | $- | $- | $- | $- | |||||||||||

| Office Tenant 2 | $- | $- | $- | $- | $- | |||||||||||

| Office Tenant 3 | $- | $- | $- | $- | $- | |||||||||||

| Operating Expense Assumptions | ||||||||||||||||

| Amount | Units | Area | %fixed | Escalation Rate | ||||||||||||

| Property Taxes | $587,159.00 | $/Year | 100% | Inflation | ||||||||||||

| Property Insurance | $0.60 | $/Area | Gross SF | 100% | Inflation | |||||||||||

| Repairs and Maintenance | $0.60 | $/Area | Gross SF | 15% | Inflation | |||||||||||

| Utilities | $0.75 | $/Area | Gross SF | 60% | Inflation | |||||||||||

| Management Fees | $30,000.00 | $/Year | 100% | Inflation | ||||||||||||

| Annual Operating Expenses | 1 | 2 | 3 | 4 | 5 | |||||||||||

| Property Taxes | $587,159.00 | $598,902.18 | $610,880.22 | $623,097.83 | $635,559.78 | |||||||||||

| Property Insurance | $60,000.00 | $61,200.00 | $62,424.00 | $63,672.48 | $64,945.93 | |||||||||||

| Repairs and Maintenance | $60,000.00 | $61,200.00 | $62,424.00 | $63,672.48 | $64,945.93 | |||||||||||

| Utilities | $75,000.00 | $76,500.00 | $78,030.00 | $79,590.60 | $81,182.41 | |||||||||||

| Management Fees | $30,000.00 | $30,600.00 | $31,212.00 | $31,836.24 | $32,472.96 | |||||||||||

| Financing Assumptions | Acquisition and Disposition Assumptions | |||||||||||||||

| LTV | 70% | Purchase Price | $34,000,000 | |||||||||||||

| DCR | 1.4 | Sale Price | ||||||||||||||

| Amortization Length (Years) | 25 | |||||||||||||||

| Payments Per Year | 12 | Discount Rate Assumptions | ||||||||||||||

| Annual Nomial Interest Rate | 6.75% | |||||||||||||||

| Rate Quoted | 1 | Before Debt Discount Rate | ||||||||||||||

| Origination Points | 1% | After Debt Discount Rate | ||||||||||||||

| Hypo Office Rent Roll | ||||||||||||||||

| Tenant | Commencement | Expiration | Rent | Parking | Expenses | Termination | ||||||||||

| Year | Month | Year | Month | Rent Area | Rent/Sq. Ft. | Rent Esc./Year | TI | Rent Abate./Month | # Parking Stalls | Rent/Stall/Month | Parking Rent Esc./Year | Expenses | Expense Esc. | Renew Option | Exercise Date | |

| Quantum Energy Solutions (Suite 1) | 1 | 1 | 5 | 12 | 40,000 | $26.00 | 0.00% | $- | 0 | 45 | 100 | Market Growth | Reimbursed | Inflation | Yes | 180-150 days prior |

| Office Tenant 2 (Suite 2) | 1 | 1 | 5 | 12 | 35,000 | $24.50 | 0.00% | $- | 0 | 35 | 100 | Market Growth | Reimbursed | Inflation | No | NA |

| 1 | 1 | 5 | 12 | 25,000 | $27.50 | 0.00% | $- | 0 | 20 | 100 | Market Growth | Reimbursed | Inflation | No | NA | |

| Hypo Office – Stabilized Pro Forma Year 1 | |

| Income | |

| Annual StabilizedRental Income | $2,500,000 |

| Operating Expense Reimbursements | $812,159 |

| Misc Income | |

| Annual Parking Income | $120,000 |

| Gross Potential Income (GPI) | $3,432,159 |

| Stabilized Vacancy and Collection Allowance | $187,500 |

| Effective Gross Income (EGI) | $3,244,659 |

| Operating Expenses | |

| Property Taxes | $587,159 |

| Property Insurance | $60,000 |

| Repairs and Maintenance | $60,000 |

| Utilities | $75,000 |

| Management Fees | $30,000 |

| Total Operating Expenses | $812,159 |

| Net Operating Income (NOI) | $2,432,500 |

| Average Leasing Expenses (Market TI and Leasing Expenses) | $- |

| Average Capital Expenditures | $24,325 |

| Adjusted Net Operating Income (adjusted NOI) | $2,408,175 |

no reviews yet

Please Login to review.