285x Filetype XLSX File size 0.17 MB Source: brokersireland.ie

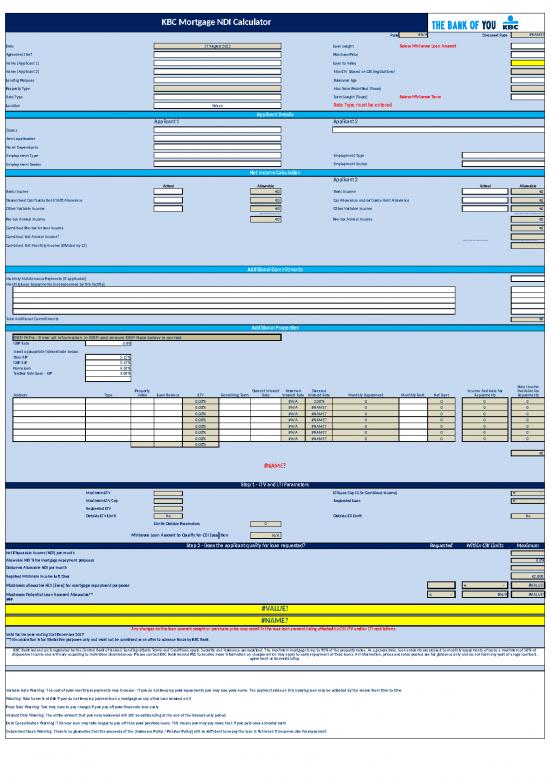

KBC Mortgage NDI Calculator

Rate #N/A Stressed Rate #NAME?

Date 17 August 2022 Loan sought Below Minimum Loan Amount

Agreement Ref Purchase Price

Name (Applicant 1) Loan to Value

Name (Applicant 2) Max LTV (Based on CBI Regulations)

Lending Purpose Borrower Age

Property Type Max Term Permitted (Years)

Rate Type Term Sought (Years) Below Minimum Term

Location Urban Rate Type must be entered

Applicant Details

Applicant 1 Applicant 2

Status

Joint application

No of Dependants

Employment Type Employment Type

Employment Sector Employment Sector

Net Income Calculation

Applicant 2

Actual Allowable Actual Allowable

Basic Income €0 Basic Income €0

Guaranteed Car/Garda Rent/Shift Allowance €0 Car Allowance and/or Garda Rent Allowance €0

Other Variable Income €0 Other Variable Income €0

---------------- -----------------------

Pre-tax Annual Income €0 Pre-tax Annual Income €0

Combined Pre-tax Annual Income €0

Combined Net Annual Income*

-------------------- --------------------

Combined Net Monthly Income (Divided by 12)

Additional Commitments

Monthly Maintenance Payments (if applicable)

Monthly Loan Repayments (not redeemed by this facility)

Total Additional Commitments €0

Additional Properties

GBP RIPs - Enter all information in GBP and ensure GBP Rate below is correct

GBP Rate 0.88

Insert appropriate interest rate below:

Euro RIP 5.15%

GBP RIP 5.15%

Homeloan 4.50%

Tracker Rate Loan - RIP 3.00%

Euro Income

Property Current Interest Assumed Stressed Income Available for Available for

Address Type Value Loan Balance LTV Remaining Term Rate Interest Rate Interest Rate Monthly Repayment Monthly Rent Net Rent Repayments Repayments

0.00% #N/A 2.00% 0 0 0 0

0.00% #N/A #NAME? 0 0 0 0

0.00% #N/A #NAME? 0 0 0 0

0.00% #N/A #NAME? 0 0 0 0

0.00% #N/A #NAME? 0 0 0 0

0.00% #N/A #NAME? 0 0 0 0

0.00% #N/A #NAME? 0 0 0 0

0.00%

€0

#NAME?

Step 1 - LTV and LTI Parameters

Maximum LTV LTI Loan Cap (3.5x Combined Income) € -

Maximum LTV Cap Requested Loan € -

Requested LTV

Outside LTV Limit No Outside LTI Limit No

Limits Outside Parameters 0

Minimum Loan Amount to Qualify for CBI Exception N/A ###

Step 2 - Does the applicant qualify for loan requested? Requested Within CBI Limits Maximum

Net Disposable Income (NDI) per month

Allowable NDI % for mortgage repayment purposes 0.0%

Customer Allowable NDI per month

Required Minimum Income Left Over €2,000

Maximum allowable NDI (Euro) for mortgage repayment purposes € - #VALUE!

Maximum Potential Loan Amount Allowable** € - #N/A #VALUE!

###

#VALUE!

#NAME?

Any changes to the loan amount sought or purchase price may result in the max loan amount being affected by CBI LTV and/or LTI restrictions.

Valid for tax year ending 31st December 2019

**This calculation is for illustrative purposes only and must not be construed as an offer to advance funds by KBC Bank.

KBC Bank Ireland plc is regulated by the Central Bank of Ireland. Lending criteria Terms and Conditions apply. Security and insurance are required. The maximum mortgage is up to 90% of the property value. As a general rule, loan amounts are subject to monthly repayments of up to a maximum of 50% of

disposable income and will vary according to individual circumstances. Please contact KBC Bank Ireland PLC to receive more information on charges which may apply to early repayment of fixed loans. All information, prices and rates quoted are for guidance only and do not form any part of a legal contract,

agreement or understanding.

Variable Rate Warning: The cost of your monthly repayments may increase - If you do not keep up your repayments you may lose your home. The payment rates on this housing loan may be adjusted by the lender from time to time

Warning: Your home is at risk if you do not keep up payments on a mortgage or any other loan secured on it

Fixed Rate Warning: You may have to pay charges if you pay off your fixed-rate loan early

Interest Only Warning: The entire amount that you have borrowed will still be outstanding at the end of the interest-only period

Debt Consolidation Warning: This new loan may take longer to pay off than your previous loans. This means you may pay more than if you paid over a shorter term

Endowment Loan Warning: There is no guarantee that the proceeds of the [Insurance Policy / Pension Policy] will be sufficient to repay the loan in full when it becomes due for repayment

KBC Mortgage NDI Calculator

Click to Clear Form Rate Chosen #N/A Please ensure rate is appropriate for LTV chosen. Stressed Rate #NAME?

Date 17 August 2022 Loan sought Below Minimum Loan Amount €0

Agreement Ref 0 Purchase Price €0

Name (Applicant 1) 0 Max LTV (Based on CBI Regulations)

Name (Applicant 2) 0 Loan to Value

Lending Purpose 0.00 Borrower Age 0

Property Type Max Term Permitted (Years) 35

Location Urban Term Sought (Years) Below Minimum Term 0

Applicant Details

Applicant 1 Applicant 2

Status 0.00 0

Joint application 0

No of Dependants 0

Employment Type 0.00 Employment Type 0.00

Employment Sector 0 Employment Sector 0

Net Income Calculation

Applicant 1 Applicant 2

Actual Allowable Actual Allowable

Basic Income €0 €0 Basic Income €0 €0

Guaranteed Car/Garda Rent/Shift Allowance €0 €0 Car Allowance and/or Garda Rent Allowance €0 €0

Other Variable Income €0 €0 Other Variable Income €0 €0

---------------- -----------------------

Pre-tax Annual Income €0 Pre-tax Annual Income €0

Combined Pre-tax Annual Income €0

Combined Net Annual Income*

-------------------- --------------------

Combined Net Monthly Income (Divided by 12)

Additional Commitments

Monthly Maintenance Payments (if applicable) €0

Monthly Loan Repayments (not redeemed by this facility)

0 €0

0 €0

0 €0

0 €0

0 €0

Total Additional Commitments €0

Additional Properties

GBP RIPs - Enter all information in GBP and ensure GBP Rate below is correct

GBP Rate 0.88

Insert appropriate interest rate below:

Euro RIP 5.15%

GBP RIP 5.15%

Homeloan 4.50%

Tracker Rate Loan - RIP 3.00%

Tracker Rate Loan - PDH 0.00%

Euro Income

Property Current Interest Assumed Stressed Income Available Available for

Address Type Value Loan Balance LTV Remaining Term Rate Interest Rate Interest Rate Monthly Repayment Monthly Rent Net Rent for Repayments Repayments

0 0 0 - 0.00% 0 0.00% #N/A 2.00% 0 0 0 0 0

0 0 0 - 0.00% 0 0.00% #N/A #NAME? 0 0 0 0 0

0 0 0 - 0.00% 0 0.00% #N/A #NAME? 0 0 0 0 0

0 0 0 - 0.00% 0 0.00% #N/A #NAME? 0 0 0 0 0

0 0 0 - 0.00% 0 0.00% #N/A #NAME? 0 0 0 0 0

0 0 0 - 0.00% 0 0.00% #N/A #NAME? 0 0 0 0 0

0 0 0 - 0.00% 0 0.00% #N/A #NAME? 0 0 0 0 0

0.00%

€0

#NAME?

Step 1 - LTV and LTI Parameters

Maximum LTV LTI Loan Cap (3.5x Combined Income) € -

Maximum LTV Cap Requested Loan € -

Requested LTV

Outside LTV Limit No Outside LTI Limit No

Limits Outside Parameters 0

Within KBC CBI Limit Criteria Yes

Minimum Loan Amount to Qualify for CBI Exception N/A

Step 2 - Does the applicant qualify for loan requested? Maximum under CBI LTI Maximum under CBI LTV Required Maximum

Net Disposable Income (NDI) per month

Allowable NDI % for mortgage repayment purposes 0.0%

Customer Allowable NDI per month

Required Minimum Income Left Over €2,000

Maximum allowable NDI (Euro) for mortgage repayment purposes

Maximum Potential Loan Amount Allowable** € - #N/A € - #NAME?

###

Max LTV Exceeded per KBC Criteria

Any changes to the loan amount sought or purchase price may result in the max loan amount being affected by CBI LTV and/or LTI restrictions.

Valid for tax year ending 31st December 2018

**This calculation is for illustrative purposes only and must not be construed as an offer to advance funds by KBC Bank.

KBC Bank Ireland plc is regulated by the Central Bank of Ireland. Lending criteria Terms and Conditions apply. Security and insurance are required. The maximum mortgage is up to 90% of the property value. As a general rule, loan amounts are subject to monthly repayments of up to a maximum of 50% of disposable income and will

vary according to individual circumstances. Please contact KBC Bank Ireland PLC to receive more information on charges which may apply to early repayment of fixed loans. All information, prices and rates quoted are for guidance only and do not form any part of a legal contract, agreement or understanding.

Variable Rate Warning: The cost of your monthly repayments may increase - If you do not keep up your repayments you may lose your home. The payment rates on this housing loan may be adjusted by the lender from time to time

Warning: Your home is at risk if you do not keep up payments on a mortgage or any other loan secured on it

Fixed Rate Warning: You may have to pay charges if you pay off your fixed-rate loan early

Interest Only Warning: The entire amount that you have borrowed will still be outstanding at the end of the interest-only period

Debt Consolidation Warning: This new loan may take longer to pay off than your previous loans. This means you may pay more than if you paid over a shorter term

Endowment Loan Warning: There is no guarantee that the proceeds of the [Insurance Policy / Pension Policy] will be sufficient to repay the loan in full when it becomes due for repayment

KBC Mortgage NDI Calculator

Click to Clear Form Rate Chosen #N/A Please ensure rate is appropriate for LTV chosen. Stressed Rate #NAME?

Date 17 August 2022 Loan sought #VALUE! #VALUE!

Agreement Ref 0 Purchase Price €0

Name (Applicant 1) 0 Max LTV (Based on CBI Regulations)

Name (Applicant 2) 0 Loan to Value

Lending Purpose 0.00 Borrower Age 0

Property Type Max Term Permitted (Years) 35

Location Urban Term Sought (Years) Below Minimum Term 0

Applicant Details

Applicant 1 Applicant 2

Status 0.00 0

Joint application 0

No of Dependants 0

Employment Type 0.00 Employment Type 0.00

Employment Sector 0 Employment Sector 0

Net Income Calculation

Applicant 1 Applicant 2

Actual Allowable Actual Allowable

Basic Income €0 €0 Basic Income €0 €0

Guaranteed Car/Garda Rent/Shift Allowance €0 €0 Car Allowance and/or Garda Rent Allowance €0 €0

Other Variable Income €0 €0 Other Variable Income €0 €0

---------------- -----------------------

Pre-tax Annual Income €0 Pre-tax Annual Income €0

Combined Pre-tax Annual Income €0

Combined Net Annual Income*

-------------------- --------------------

Combined Net Monthly Income (Divided by 12)

Additional Commitments

Monthly Maintenance Payments (if applicable) €0

Monthly Loan Repayments (not redeemed by this facility)

0 €0

0 €0

0 €0

0 €0

0 €0

Total Additional Commitments €0

Additional Properties

GBP RIPs - Enter all information in GBP and ensure GBP Rate below is correct

GBP Rate 0.88

Insert appropriate interest rate below:

Euro RIP 5.15%

GBP RIP 5.15%

Homeloan 4.50%

Tracker Rate Loan - RIP 3.00%

Tracker Rate Loan - PDH 0.00%

Euro Income

Property Current Interest Assumed Stressed Income Available Available for

Address Type Value Loan Balance LTV Remaining Term Rate Interest Rate Interest Rate Monthly Repayment Monthly Rent Net Rent for Repayments Repayments

0 0 0 - 0.00% 0 0.00% #N/A 2.00% 0 0 0 0 0

0 0 0 - 0.00% 0 0.00% #N/A #NAME? 0 0 0 0 0

0 0 0 - 0.00% 0 0.00% #N/A #NAME? 0 0 0 0 0

0 0 0 - 0.00% 0 0.00% #N/A #NAME? 0 0 0 0 0

0 0 0 - 0.00% 0 0.00% #N/A #NAME? 0 0 0 0 0

0 0 0 - 0.00% 0 0.00% #N/A #NAME? 0 0 0 0 0

0 0 0 - 0.00% 0 0.00% #N/A #NAME? 0 0 0 0 0

0.00%

€0

#NAME?

Step 1 - LTV and LTI Parameters

Maximum LTV LTI Loan Cap (3.5x Combined Income) € -

Maximum LTV Cap Requested Loan #VALUE!

Requested LTV

Outside LTV Limit No Outside LTI Limit #VALUE!

Limits Outside Parameters 0

Within KBC CBI Limit Criteria Yes

Minimum Loan Amount to Qualify for CBI Exception N/A

Step 2 - Does the applicant qualify for loan requested? Minimum Amount to get LTI Exception Minimum Amount to get LTV Exception Lending Amount Within Criteria Required Maximum

Net Disposable Income (NDI) per month

Allowable NDI % for mortgage repayment purposes 0.0%

Customer Allowable NDI per month

Required Minimum Income Left Over €2,000

Maximum allowable NDI (Euro) for mortgage repayment purposes

Maximum Potential Loan Amount Allowable** #N/A #VALUE! #N/A #VALUE! #N/A

###

Max LTV Exceeded per KBC Criteria

Valid for tax year ending 31st December 2018

**This calculation is for illustrative purposes only and must not be construed as an offer to advance funds by KBC Bank.

KBC Bank Ireland plc is regulated by the Central Bank of Ireland. Lending criteria Terms and Conditions apply. Security and insurance are required. The maximum mortgage is up to 90% of the property value. As a general rule, loan amounts are subject to monthly repayments of up to a maximum of 50% of disposable income and will vary according to individual circumstances. Please contact

KBC Bank Ireland PLC to receive more information on charges which may apply to early repayment of fixed loans. All information, prices and rates quoted are for guidance only and do not form any part of a legal contract, agreement or understanding.

Variable Rate Warning: The cost of your monthly repayments may increase - If you do not keep up your repayments you may lose your home. The payment rates on this housing loan may be adjusted by the lender from time to time

Warning: Your home is at risk if you do not keep up payments on a mortgage or any other loan secured on it

Fixed Rate Warning: You may have to pay charges if you pay off your fixed-rate loan early

Interest Only Warning: The entire amount that you have borrowed will still be outstanding at the end of the interest-only period

Debt Consolidation Warning: This new loan may take longer to pay off than your previous loans. This means you may pay more than if you paid over a shorter term

Endowment Loan Warning: There is no guarantee that the proceeds of the [Insurance Policy / Pension Policy] will be sufficient to repay the loan in full when it becomes due for repayment

APPLICATION_STATUS #N/A 1 0.00 0 0 2.00

SELF_EMPLOYED #N/A #N/A 0.00 0.00

APPLICATION_TYPE #N/A Two Incomes No

MORTGAGE_TYPE 0.00

EMPLOYMENT SECTOR 0.00 0.00

First Second Combined Joint

1 1

Applicant Income Details

GROSS_INCOME - - - -

Single Person - - - -

Married - One Income - - - -

Married - Two Income - - - -

One Parent/Widowed Parent - - - -

PRSI_Ceiling - -

PRSI_Floor - -

PRSI_Exemption - -

Taxable_Higher_Rate - - - -

Taxable_Standard_Rate - - - - 2.00

Taxable_PRSI - All Income - - - -

Taxable_Universal_Social_Charge - all income - - - -

Tax_Rate_Higher 0.40 0.40

Tax_Rate_Standard 0.20 0.20

Tax_Rate_PRSI 0.04 0.04

Tax_Rate_Universal_Social_Charge total income less than €13,000 - -

Tax_Rate_Universal_Social_Charge first €12,012 0.005 0.005

Tax_Rate_Universal_Social_Charge next €7,862 0.020 0.020

Tax_Rate_Universal_Social_Charge amts above €19,874 to €70,044 0.0450 0.0450

Tax_Rate_Universal_Social_Charge amts above €70,044 PAYE ONLY 0.080 0.080

Tax_Rate_Universal_Social_Charge amts €70,044 to €100,000 SELF-EMPLOYED ONLY 0.080 0.080

Tax_Rate_Universal_Social_Charge amts above €100,000, SELF-EMPLOYED ONLY 0.110 0.110

USC Band A - Amt 12,012.00 12,012.00 20,072.00 20,072.00

USC Band B - Amt 7,862.00 7,862.00 11,960.00 11,960.00

USC Band C - Amt 50,170.00 50,170.00

USC Band D - Amt 70,044.00 70,044.00

USC Band E - Amt 29,956.00 29,956.00

USC Band F - Amt 100,000.00 100,000.00

Pension Levy Band A - Amt - -

Pension Levy Band B - Amt - -

Pension Levy Band C - Amt - -

Tax Chargeable

Tax_Higher_Rate - - - - -

Tax_Standard_Rate - - - - -

Tax_Rate_PRSI - - - - -

Tax_Rate_Universal_Social_Charge first €12,012 - - - - -

Tax_Rate_Universal_Social_Charge next €7,862 B - - - - -

Tax_Rate_Universal_Social_Charge amts €19,874 to €70,044 - - - - -

Tax_Rate_Universal_Social_Charge amts above €70,044 PAYE ONLY - - - - -

Tax_Rate_Universal_Social_Charge amts €70,044 to €100,000 SELF-EMPLOYED ONLY - - - - -

Tax_Rate_Universal_Social_Charge amts above €100,000, SELF-EMPLOYED ONLY - - - - -

Pension Levy Band 1, Rate 1 - - - - -

Pension Levy Band 2, Rate 2 - - - - -

Pension Levy Band 3, Rate 3 - - - - -

Tax_Chargeable - - - - -

Tax Credits

Personal_Tax_Credit - - - -

Married - One working - - - -

PAYE_Credit - - - -

Self_Employed_Credit - - - -

Limited to PAYE charge

Tax_Credits - - - -

Net_Disposable_Income - - - -

Net Monthly Income - -

no reviews yet

Please Login to review.