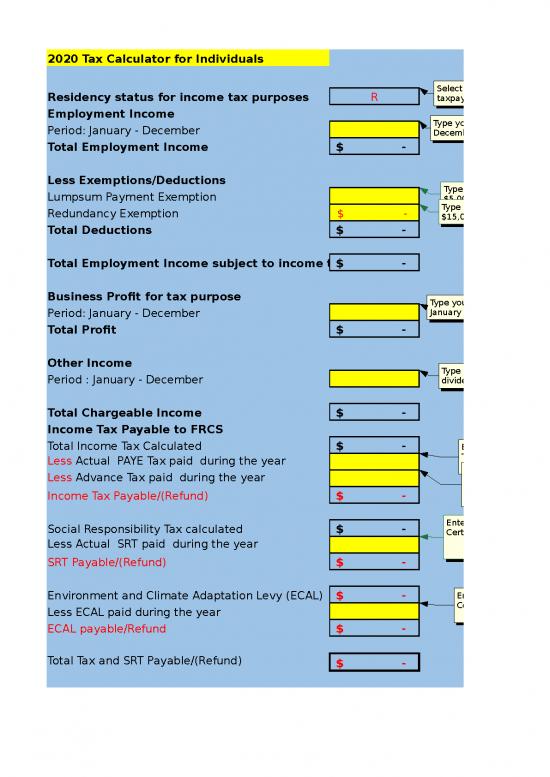

| 2020 Tax Calculator for Individuals |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Residency status for income tax purposes |

Select "R" for Resident or "N" for Non-Resident taxpayer

R |

|

|

|

|

|

|

|

| Employment Income |

|

|

|

|

|

|

|

|

| Period: January - December |

Type your Salary for January - December

|

|

|

|

|

|

|

|

| Total Employment Income |

$- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less Exemptions/Deductions |

|

|

|

|

|

|

|

|

| Lumpsum Payment Exemption |

Type lumpsum exemption if applicable. Max is $5,000

|

|

|

|

|

|

|

|

| Redundancy Exemption |

Type redudancy exemption if applicable. Max is $15,000

$- |

|

|

|

|

|

|

|

| Total Deductions |

$- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Employment Income subject to income tax |

$- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Business Profit for tax purpose |

|

|

|

|

|

|

|

|

| Period: January - December |

Type your business net profit for January - December

|

|

|

|

|

|

|

|

| Total Profit |

$- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Income |

|

|

|

|

|

|

|

|

| Period : January - December |

Type total of all other income except interest and dividend earned from January to December

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Chargeable Income |

$- |

|

|

|

|

|

|

| Income Tax Payable to FRCS |

|

|

|

|

|

|

| Total Income Tax Calculated |

$- |

|

|

|

|

|

|

|

| Less Actual PAYE Tax paid during the year |

Enter total PAYE tax deducted as shown in the Withholding Tax Certificate issued by the employer.

|

|

|

|

|

|

|

|

| Less Advance Tax paid during the year |

Enter total advance tax deducted or paid in 2018

|

|

|

|

|

|

|

|

| Income Tax Payable/(Refund) |

$- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Social Responsibility Tax calculated |

$- |

|

|

|

|

|

|

|

| Less Actual SRT paid during the year |

Enter total SRT deducted as shown in the Withholding Tax Certificate issued by the employer.

|

|

|

|

|

|

|

|

| SRT Payable/(Refund) |

$- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Environment and Climate Adaptation Levy (ECAL) |

$- |

|

|

|

|

|

|

|

| Less ECAL paid during the year |

Enter total ECAL deducted as shown in the Withholding Tax Certificate issued by the employer.

|

|

|

|

|

|

|

|

| ECAL payable/Refund |

$- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Tax and SRT Payable/(Refund) |

$- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2020 Tax Calculator for Individuals |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Residency status for income tax purposes |

Select "R" for Resident or "N" for Non-Resident taxpayer

R |

|

|

|

|

|

|

|

| Employment Income |

|

|

|

|

|

|

|

|

| Period: January - December |

Type your Salary for January - December

$300,000.00 |

|

|

|

|

|

|

|

| Total Employment Income |

$300,000.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less Exemptions/Deductions |

|

|

|

|

|

|

|

|

| Lumpsum Payment Exemption |

Type lumpsum exemption if applicable. Max is $5,000

|

|

|

|

|

|

|

|

| Redundancy Exemption |

Type redudancy exemption if applicable. Max is $15,000

$- |

|

|

|

|

|

|

|

| Total Deductions |

$- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Employment Income subject to income tax |

$300,000.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Business Profit for tax purpose |

|

|

|

|

|

|

|

|

| Period: January - December |

Type your business net profit for January - December

|

|

|

|

|

|

|

|

| Total Profit |

$- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other Income |

|

|

|

|

|

|

|

|

| Period : January - December |

Type total of all other income except interest and dividend earned from January to December

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Chargeable Income |

$300,000.00 |

|

|

|

|

|

|

| Income Tax Payable to FRCS |

|

|

|

|

|

|

| Total Income Tax Calculated |

$53,600.00 |

|

|

|

|

|

|

|

| Less Actual PAYE Tax paid during the year |

Enter total PAYE tax deducted as shown in the Withholding Tax Certificate issued by the employer.

$10,650.23 |

|

|

|

|

|

|

|

| Less Advance Tax paid during the year |

Enter total advance tax deducted or paid in 2018

|

|

|

|

|

|

|

|

| Income Tax Payable/(Refund) |

$42,949.77 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Social Responsibility Tax calculated |

$3,900.00 |

|

|

|

|

|

|

|

| Less Actual SRT paid during the year |

Enter total SRT deducted as shown in the Withholding Tax Certificate issued by the employer.

|

|

|

|

|

|

|

|

| SRT Payable/(Refund) |

$3,900.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Environment and Climate Adaptation Levy (ECAL) |

$3,000.00 |

|

|

|

|

|

|

|

| Less ECAL paid during the year |

Enter total ECAL deducted as shown in the Withholding Tax Certificate issued by the employer.

|

|

|

|

|

|

|

|

| ECAL payable/Refund |

$3,000.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Tax and SRT Payable/(Refund) |

$49,849.77 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|