289x Filetype PDF File size 0.15 MB Source: hindujahousingfinance.com

MOST IMPORTANT TERMS AND CONDITIONS (MITC)

(For individual Housing Loan)

The Most Important Terms and Conditions ("the MITC") for the housing loan ("the Loan") availed by an individual Borrower(s) from

Hinduja Housing Finance Limited, a Company incorporated under the Companies Act, 2013 and having Its registered & Corporate

office at No. 27A, Developed Plot, Guindy Industrial Estate, Guindy, Chennai - 600032, hereinafter referred to as "HHFL" are

mentioned below and are to be read and understood in conjunction with the terms contained in the Sanction Letter, Disbursement

Letter and the Loan Documents which shall be executed in reference to the Loan with HHFL (Collectively referred to as 'the "Loan

Documents")

The MITCs mentioned here are merely indicative and not exhaustive. The Loan shall be governed by the Loan Documents including

the Sanction Letter. In the event on a contradiction between of the terms and conditions set out herein and the Loan Documents,

the terms and conditions of the Loan Documents shall prevail.

a) Loan

The term of the loan, its purpose, the applicable rate of interest and the tenure shall be as set out under the Sanction Letter. Please

read the Sanction Letter carefully for specific details. The Loan shall be determined on the basis of the credit appraisal of the profile,

income and valuation of the security being offered.

i. Fixed Rate - In the event the Borrower(s) has opted for a Fixed Rate of interest, the interest rate shall remain fixed throughout the

tenure of the Loan, unless otherwise agreed in terms of agreement, save and except as provided herein above, the applicable Fixed

Rate shall be the prevailing interest rate on the date of Disbursement.

ii. Floating Rate - In the event you have opted for the Floating Rate of interest, you shall be liable to pay the interest at the Floating

Rate +/- the margin (in terms of %). The Floating rate of interest shall be based on HBLR as decided by HHFL from time to time.

"HBLR" shall mean the applicable reference rate of interest as on the reset date and reset time frequency as decided by HHFL from

time to time based on prevailing market conditions and guidelines of any statutory authority and / or as per internal policy of HHFL.

Any change in HBLR shall be notified by HHFL through its website or account statements or its branches or any such medium as

HHFL may consider appropriate.

iii. Fixed & Floating Rate - In the event you have opted for Fixed & Floating rate of interest, you shall be liable to pay the Fixed Rate

of interest for an initial period in the manner indicated under Clause A (i) above and after the said initial period at the Floating Rate

in the manner as indicates under Clause A (ii) above.

iv. At the sole discretion of HHFL, you shall have an option to convert from Fixed Rate of Interest scheme to a Floating Rate of

Interest scheme or vice versa, post payment of applicable switch charges on the principal outstanding and service tax as applicable

at the time of exercising this option.

v. Notwithstanding anything to the contrary stated hereinabove, the rate of interest is subject to revision in terms of the Sanction

Letter to be executed by you.

Tenure - The Loan tenure shall be fixed at the discretion of HHFL which shall depend on the age of the Borrower(s), risk profile, age

of the Property and the specific product/ program opted by the Borrower(s). The tenure of the Loan may be modified by HHFL in its

sole discretion at any time during the Loan.

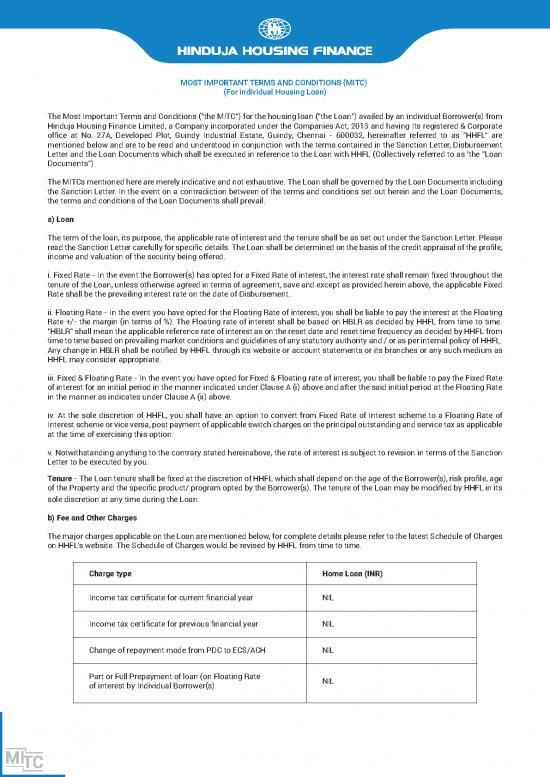

b) Fee and Other Charges

The major charges applicable on the Loan are mentioned below, for complete details please refer to the latest Schedule of Charges

on HHFL's website. The Schedule of Charges would be revised by HHFL from time to time.

Charge type Home Loan (INR)

Income tax certificate for current financial year NIL

Income tax certificate for previous financial year NIL

Change of repayment mode from PDC to ECS/ACH NIL

Part or Full Prepayment of loan (on Floating Rate NIL

of interest by Individual Borrower(s)

Cheque/ECS return Rs. 250/- + Applicable Taxes

CERSAI charge for creation of Security interest NIL

NIL for once every year and

Statement of account 200 + Applicable Taxes

for every additional

Change of repayment mode-PDC to PDC or Rs. 500/- + Applicable Taxes

ECS to ECS PDC/ECS to ACH

EMI payment fee on account of non- submission of Rs. 300/- + Applicable Taxes

PDC/ECS (per transaction)/ACH

Part or Full Prepayment or Cancellation of loan 2% of principal prepaid

(on Floating Rate of Interest) by non- individual Borrower(s) + Applicable Taxes

being applicant or co-applicant of loan against property

2% of principal prepaid + Applicable Taxes.

Part or Full Prepayment of loan (on Fixed Rate of Interest) In case of prepayment of loan is by own

by individual Borrower(s) source (except borrowing from Bank/HFC/

NBFC/Any Financial Institution),

no fee is Applicable.

Part or Full Prepayment of loan (on Fixed Rate of Interest) 2% of principal prepaid

by non- individual Borrower(s) being applicant + Applicable Taxes

or co-applicant

Loan Pre-closure statement or List of original Property Rs. 500/- + Applicable Taxes

documents or Photocopy of original Property documents

Processing fee* Minimum 1.00% of the loan applied for

+ Applicable Taxes

Overdue charge 3% per month on overdue payment

Recovery fees As per actual

Legal and Technical fees Rs. 5999/-

Cancellation Charges for all types of loans Rs. 10,000/-

other than loan against property

c) Security for the Loan

The Security for the Loan would generally be security interest on the Property being financed and / or any other collateral / interim

security as may be required by HHFL.The Security shall include guarantee, Mortgage, hypothecation and any other form of security

as deemed fit by HHFL.

The Loan shall be secured by first and exclusive charge on the Property offered as collateral security (the details whereof are set

out in the Loan Documents) which shall have a clear, marketable and unencumbered title. The Borrower(s) shall produce such

original/copy of title deeds, documents, reports as may be required by HHFL. The Borrower(s) shall bear all the charges payable for

the creation of said Security and shall take all the steps required for the perfection thereof. The plan for the construction of the

Property offered as Security shall be approved by the competent authority and the same shall not be violated by the Borrower(s) or

any other person at any point of time during the currency of the Loan.

d) Insurance of the Property/ Borrower(s)

It will be the Borrower(s)' responsibility to ensure that the Property offered as Security is duly and properly insured against fire and

other hazards for an amount specified by HHFL during the period of this Loan with HHFL as sole beneficiary. The evidence thereof

shall be given to HHFL every year and/or whenever asked for by HHFL. Regardless of the amount being specified by HHFL for the

said purpose, the Borrower(s) shall remain absolutely obligated to insure the Property for an adequate amount.

The terms & conditions including claims & coverage will be governed by the issuer of such insurance policy. Please note that the

role of HHFL under the insurance policy would be that of a facilitator and the decision to cover and settle any future claim under the

policy would solely rest with the insurance company. Insurance is the subject matter of solicitation.

e) Conditions for Disbursement of the Loan

The conditions for the Disbursement of the Loan shall be mentioned under the Loan Documents in detail however, some of the

salient and major conditions are mentioned below:

• Submission of all relevant documents as mentioned by HHFL in the Loan Documents.

• Legal & technical assessment of the Property.

• Payment of own contribution by the Borrower(s) (total cost of flat less the Loan amount), as specified in the Disbursement Letter.

• Providing adequate utilization proof of the Loan.

• Undertaking by the Borrower to regularly provide HHFL information, including details regarding progress / delay in construction,

any major damage to the Property, change in employment/ contact details, non-payment of taxes pertaining to Property, etc.

• The construction is being undertaken as per the approved plans.

• The Borrower(s) has satisfied himself/herself that required approvals for the project have been obtained by the developer.

• All required approvals for the Property have been obtained and are available with the seller in case the Property is being

purchased in resale.

f) Repayment of the Loan & Interest

i. The Loan will be repayable through the Equated Monthly Installments ("EMIs") payable on monthly basis on the Due Date

mentioned in the Disbursement Letter. The EMIs shall be calculated on the amount actually Disbursed which shall be subject to

the revision at the discretion of HHFL. Exact EMIs will be calculated at the time of final Disbursement.

ii. Pre-EMI Interest ("PEMII") would be required to be paid, on monthly basis on the Due Date mentioned in the Disbursement

Letter. It shall be charged from the date of the first Disbursements to the date of commencement of EMI in respect of the Loan.

iii. In case of delayed payment, overdue interest for the delayed period will be charged at rates as determined by HHFL from time

to time.

iv. HHFL shall have the right and sole discretion to revise the EMIs or to revise Repayment period or both consequent upon

change/revision in interest rate and/or in HBLR and accordingly fresh set of Post Dated Cheques ("PDCs") shall be deposited

and/or irrevocable ECS/ACH mandate shall be given by you suomotu for revised EMIs

v. Without limiting to the generality of the aforesaid, the Borrower(s) shall provide such number of PDC's as mandated by HHFL

from time to time for the amounts specified by HHFL towards Repayment of the Loan.

Prepayment Charges - Prepayment Charges (s) will be levied in accordance with the guidelines / circulars of HHFL for Loan Against

Property Only.

g) Brief indicative procedure to be followed for Recovery of the Over dues

On occurrence of any event of default as mentioned in the Loan Documents ("Event of Default"), all outstanding amounts owed by

the Borrower(s) to HHFL shall become payable forthwith and HHFL reserves the right to undertake such necessary

processes/measures to enforce its rights under the Loan Documents including but not limited to charging Additional Interest for

the delayed payment, recovery of over dues by enforcing the Security in accordance with the remedy available under the Law. The

actual procedure shall be determined by HHFL depending upon the circumstances of each case.

h) Customer Service

a) Visiting hours at the office - 10:30 AM to 4:30 PM (Monday to Friday) and 10:30 AM to 1:30 PM (Saturday). Office remains closed

on Sunday and Second Saturday;

b) Details of the person to be contacted for customer service - Customer Service Officer at branch office of HHFL;

c) Procedure to obtain the following including time line thereof:

i. Loan account statement

ii. Photocopy of the title documents

iii. Return of original documents on closure/transfer of the Loan

NOTE: Borrower(s) can obtain these services from branch by providing loan account number and identity proof. Alternatively the

Borrower can write to HHFL by accessing its website support@hindujahousingfinance.com

i) Grievance Redressal

• In case of any grievances, the Customers may contact the Branch Manager/Zonal Heads/Area Heads at the respective

branches, where they have taken the loan, in writing, through email or by post / courier. A Complaint Register is also made

available at our branches for the Customers to record their complaint in writing.

• In case the customer does not receive response from the branch within 15 days or is dissatisfied the customers may approach

the Grievance Redressal Officer as per the details furnished hereunder: Venkatesh.R, No. 27-A, Developed Industrial Estate,

Guindy, Chennai – 600032, Phone: 044-2242 5725 Email: compliance@hindujahousingfinance.com

• In case, the customer does not receive response from the Company within 30 days or is dissatisfied with the response received,

the Customer may also approach the Complaint Redressal Cell of National Housing Bank by lodging a complaint in online mode

at https://grids.nhbonline.org.in or in offline mode by writing to Complaint Redressal Cell, Department of Regulation and

Supervision, National Housing Bank, 4th Floor, Core 5A, India Habitat Centre, Lodhi Road, New Delhi – 110003.

(Borrower(s) Name & Signature)

1.

2.

3.

4.

For any assistance on your loan account, please write to compliance@hindujahousingfinance.com

Our customer service officer will assist you.

no reviews yet

Please Login to review.