297x Filetype PDF File size 0.06 MB Source: www.hdbfs.com

To, Date:

(Applicant)

(Address)

Contact Number:

Ref Number: LOS ID – ____________

Dear Sir/Madam

At your request, we are pleased to advice in principle sanction of a Secured Loan on the agreed terms and conditions as

per this letter.

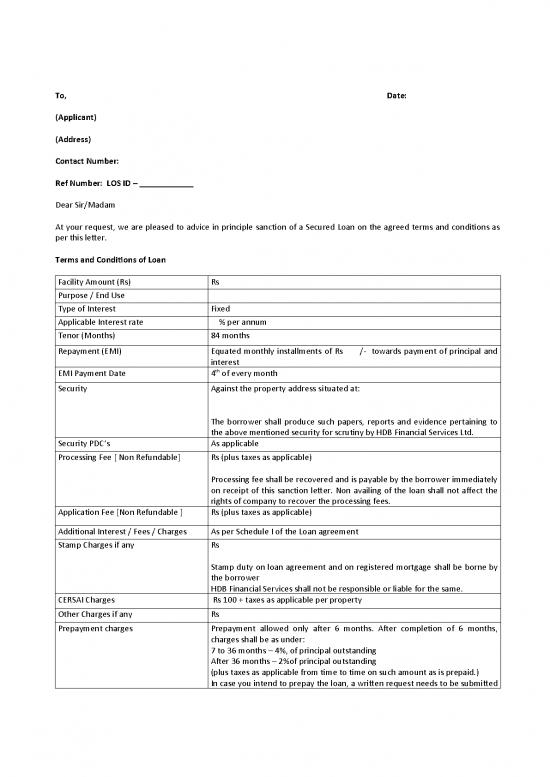

Terms and Conditions of Loan

Facility Amount (Rs) Rs

Purpose / End Use

Type of Interest Fixed

Applicable Interest rate % per annum

Tenor (Months) 84 months

Repayment (EMI) Equated monthly installments of Rs /- towards payment of principal and

interest

th

EMI Payment Date 4 of every month

Security Against the property address situated at:

The borrower shall produce such papers, reports and evidence pertaining to

the above mentioned security for scrutiny by HDB Financial Services Ltd.

Security PDC’s As applicable

Processing Fee [ Non Refundable] Rs (plus taxes as applicable)

Processing fee shall be recovered and is payable by the borrower immediately

on receipt of this sanction letter. Non availing of the loan shall not affect the

rights of company to recover the processing fees.

Application Fee [Non Refundable ] Rs (plus taxes as applicable)

Additional Interest / Fees / Charges As per Schedule I of the Loan agreement

Stamp Charges if any Rs

Stamp duty on loan agreement and on registered mortgage shall be borne by

the borrower

HDB Financial Services shall not be responsible or liable for the same.

CERSAI Charges Rs 100 + taxes as applicable per property

Other Charges if any Rs

Prepayment charges Prepayment allowed only after 6 months. After completion of 6 months,

charges shall be as under:

7 to 36 months – 4%, of principal outstanding

After 36 months – 2%of principal outstanding

(plus taxes as applicable from time to time on such amount as is prepaid.)

In case you intend to prepay the loan, a written request needs to be submitted

at our branch providing us a notice period of 30 days for your prepayment

request.

Insurance The borrower shall always keep the property insured against fire, earth quake

terrorism, floods etc. A copy of the insurance policy shall be submitted to HDB

Financial Services branch every year.

This letter shall form an integral part of the loan agreement and other documents to be executed by yourselves and shall

be governed by the terms and conditions as contained in the loan agreement. The terms specifically contained in this

letter shall have precedence over the loan agreement. The offer is valid for 30 days from the date of the sanction. Stamp

duty and other processing charges, if any on the loan documents shall be borne and paid by the Borrower only and HDB

Financial Services shall not be responsible or liable for the same.

Depending on the valuation of security/ property from time to time, the company may ask for additional security as may

be required to retain necessary margin.

Repayment is by EMI (Equated Monthly Installments) which comprises of principal and interest calculated on the basis of

monthly rests at the rate applicable. EMI will be applicable on disbursed amounts. All accounts are subject to a quarterly

review. The company reserves the right to increase interest rates on the said facility by the penal/ default interest rate

mentioned in Schedule I of the loan agreement, if the conduct of the account is found to be unsatisfactory with respect to

repayment of the EMI.

HDB Financial Services Ltd shall be informed in writing about any change/loss of job/business, profession, (as the case

may be) immediately after such change/loss.

HDB Financial Services Ltd shall be allowed to inspect the collateral with prior notice and submit the financials on yearly

basis on request.

HDB Financial Services Ltd shall have a general lien and right to set-off all your monies/securities standing to the credit in

any loan account(s) held with us.

HDB Financial Services Ltd shall debit/adjust/hold lien on any such account(s)/securities, against any principal or interest

or other dues payable by you to us.

HDB Financial Services Limited reserves the right to withdraw and/or amend any of the terms and conditions hereof

(including to reduce or cancel the loan) at its sole discretion, in the event of any change in circumstances & subject to

legal and title clearance of the collateral offered.

This letter of offer shall stand revoked and/or cancelled and shall be absolutely null and void if:

a) There are any material changes in the proposal for which the Loan is sanctioned;

b) Any statement made in the loan application or documents submitted by you are found to be incorrect or untrue.

Kindly confirm your acceptance of the aforesaid terms and conditions by signing on all pages of this sanction letter and

returning the same to us.

We value your relationship with us and assure you of our best services always.

Yours faithfully,

For HDB Financial Services Limited

(Authorized Signatory)

(BCM / ACM Name – Designation and Employee Number)

Special Conditions if Any:

✔ In case of Balance Transfer, BT Kit containing Letter of Authority duly signed by all borrowers, Affidavit Buyover,

Loan Buyout Authorization to be submitted as per prescribed format along with LOD & prepayment statement

from the current financier.

✔ MOE / MOTD / PTM to be done for the collateral

✔ Fixed Deposit of Rs ________ to be created in HDFC Bank and lien to be marked in favor of HDB Financial

Services Limited

✔ The above mentioned loan amount includes Credit Protect Insurance (CP+) Premium amount

✔ Property Insurance to be done for the collateral

Additional Documentation if Any:

✔ Loan Agreement + Demand Promissory Note

✔ ACH / ECS Mandate to be given for EMI payable.

✔ 1 Cheque towards entire loan amount

We accept

Name Signature and Date

1. ___________________

2. ___________________

3. ___________________

no reviews yet

Please Login to review.