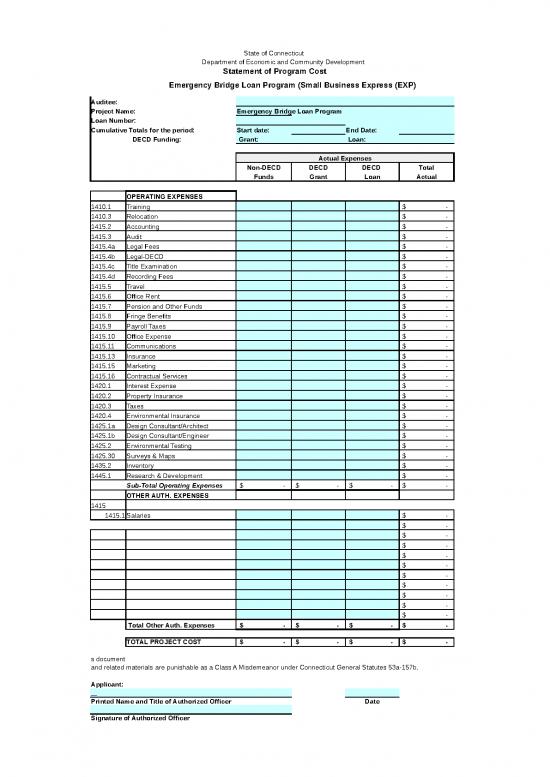

| State of Connecticut |

| Department of Economic and Community Development |

| Statement of Program Cost |

|

Emergency Bridge Loan Program (Small Business Express (EXP) |

|

|

|

|

|

|

|

Name of the company being audited.

Auditee: |

|

|

Name applicant has given to the DECD request.

Project Name: |

Emergency Bridge Loan Program |

| Loan Number: |

|

|

|

|

|

|

You must identify a budget period. The budget period start date is the date that you submit your application. The end date is a date you identify on this budget as the date you will be able to complete this request.

Cumulative Totals for the period: |

Start date: |

|

End Date: |

|

| DECD Funding: |

Grant: |

|

Loan: |

|

|

|

|

|

|

|

|

|

Actual Expenses |

|

|

Non-DECD |

DECD |

DECD |

Total |

|

|

Funds |

Grant |

Loan |

Actual |

|

|

|

|

|

|

|

OPERATING EXPENSES |

|

|

|

|

| 1410.1 |

Insert cost of training new employees.

Training |

|

|

|

$- |

| 1410.3 |

costs associated with relocation payments to individuals or incurred for moving the business to a new location.

Relocation |

|

|

|

$- |

| 1415.2 |

Insert costs for bookkeeping services.

Accounting |

|

|

|

$- |

| 1415.3 |

Insert fees and expenses paid to an independent public accounting firm in connection with a state or federal project audit.

Audit |

|

|

|

$- |

| 1415.4a |

Fees associated with acquiring a project site or fees associated with executing a DECD closing.

Legal Fees |

|

|

|

$- |

| 1415.4b |

Legal fees DECD incurs in contract closing.

Legal-DECD |

|

|

|

$- |

| 1415.4c |

Insert costs in connection with the examination of property title.

Title Examination |

|

|

|

$- |

| 1415.4d |

Insert costs associated with recording of deeds or other instruments associated with the project.

Recording Fees |

|

|

|

$- |

| 1415.5 |

Insert the costs associated with business travel in connection with the project.

Travel |

|

|

|

$- |

| 1415.6 |

Insert rental paid for office space.

Office Rent |

|

|

|

$- |

| 1415.7 |

Insert Company's share of contribution towards a pension plan.

Pension and Other Funds |

|

|

|

$- |

| 1415.8 |

Insert company's share of health/life insurance, and other costs related to salary and wages.

Fringe Benefits |

|

|

|

$- |

| 1415.9 |

Insert the project's share of payroll taxes, including FICA, Medicare Taxes and State and Federal Unemployment Taxes.

Payroll Taxes |

|

|

|

$- |

| 1415.10 |

Insert the cost of all stationary, office supplies, postage,binders, vouchers and checks.

Office Expense |

|

|

|

$- |

| 1415.11 |

Insert costs for telephone, telegraph and messenger/answering services.

Communications |

|

|

|

$- |

| 1415.13 |

Insert the cost of insurance premiums that are not related to land or buildings.

Insurance |

|

|

|

$- |

| 1415.15 |

Insert costs associated with professional consulting services to survey, evaluate and prepare reports on anticipated market impacts. Also include costs associated with advertising products or business.

Marketing |

|

|

|

$- |

| 1415.16 |

Insert contractural services costs relating directly with the functions mof the project/program.

Contractual Services |

|

|

|

$- |

| 1420.1 |

Insert interest to be paid or accrued on loan advances from other lending institutions.

Interest Expense |

|

|

|

$- |

| 1420.2 |

Insert cost of project property and general liability insurance.

Property Insurance |

|

|

|

$- |

| 1420.3 |

Insert cost of project property taxes paid or accrued.

Taxes |

|

|

|

$- |

| 1420.4 |

If applicable, insert cost of insurance.

Environmental Insurance |

|

|

|

$- |

| 1425.1a |

Insert fees paid to the project Architect.

Design Consultant/Architect |

|

|

|

$- |

| 1425.1b |

Insert fees paid to project Engineer.

Design Consultant/Engineer |

|

|

|

$- |

| 1425.2 |

Insert costs incurred for boring or tests in connection with selection of the project site.

Environmental Testing |

|

|

|

$- |

| 1425.30 |

Insert the costs of all surveys and maps company is required to pay for in accordance with the architects agreement.

Surveys & Maps |

|

|

|

$- |

| 1435.2 |

Insert the cost of purchasing company merchandise and raw materials to made into finished goods for sale.

Inventory |

|

|

|

$- |

| 1445.1 |

Insert costs associated with discovering new knowledge about products, processes and services.

Research & Development |

|

|

|

$- |

|

Sub-Total Operating Expenses |

$- |

$- |

$- |

$- |

|

OTHER AUTH. EXPENSES |

|

|

|

|

| 1415 |

|

|

|

|

|

| 1415.1 |

example: insert up to 50% salary exp or other Commissioner approved expenses.

Salaries |

|

|

|

$- |

|

|

|

|

|

$- |

|

|

|

|

|

$- |

|

|

|

|

|

$- |

|

|

|

|

|

$- |

|

|

|

|

|

$- |

|

|

|

|

|

$- |

|

|

|

|

|

$- |

|

|

|

|

|

$- |

|

|

|

|

|

$- |

|

example: insert up to 50% salary exp or other Commissioner approved expenses.

|

|

|

|

$- |

|

Total Other Auth. Expenses |

$- |

$- |

$- |

$- |

|

|

|

|

|

|

|

TOTAL PROJECT COST |

$- |

$- |

$- |

[Threaded comment]

Your version of Excel allows you to read this threaded comment; however, any edits to it will get removed if the file is opened in a newer version of Excel. Learn more: https://go.microsoft.com/fwlink/?linkid=870924

Comment:

This total should match total expenses on the Profit and Loss Statement of the auditee

$- |

|

|

|

|

|

|

| I certify that the information provided on this form is accurate and complete. False statements made in the preparation and submission of this document |

|

|

|

|

|

| and related materials are punishable as a Class A Misdemeanor under Connecticut General Statutes 53a-157b. |

|

|

|

|

|

|

|

|

|

|

|

| Applicant: |

|

|

|

|

|

| |

|

|

|

|

|

| Printed Name and Title of Authorized Officer |

|

|

|

Date |

|

|

|

|

|

|

|

| Signature of Authorized Officer |

|

|

|

|

|

| State of Connecticut |

|

|

|

|

| Department of Economic and Community Development |

|

|

|

|

| Statement of Program Cost |

|

|

|

|

|

SMALL BUSINESS EXPRESS PROGRAM (EXP) - (SAMPLE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of the company requesting the funding

Applicant |

XYZ, LLC |

|

|

|

|

|

|

Name applicant has given to the DECD request.

Project Name |

Expansion Project |

|

|

|

|

|

| Contract Number |

|

2012-170-015-200-001-1A |

|

|

|

|

|

|

|

|

|

You must identify a budget period. The budget period start date is the date that you submit your application. The end date is a date you identify on this budget as the date you will be able to complete this request.

Cumulative Totals for the period: |

Start date: |

4/1/2012 |

End Date: |

3/31/2013 |

|

|

|

|

|

| DECD Funding: |

Grant: |

$70,000.00 |

Loan: |

$60,000.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

APPROVED BUDGET |

|

ACTUAL |

|

|

Non-DECD |

DECD |

DECD |

Total |

|

Non-DECD |

DECD |

DECD |

Total |

|

|

Funds |

Grant |

Loan |

Budget |

|

Funds |

Grant |

Loan |

Actual |

|

CAPITAL COSTS |

|

|

|

|

|

|

|

|

|

| 1405.1 |

Insert cost to purchase real estate associated with the project.

Land Cost/Site Acquisition |

|

|

|

$- |

|

|

|

|

$- |

| 1405.2 |

Include only those fees for appraisals that have been made on land designated as suitable by DECD.

Appraisal Fees |

|

|

|

$- |

|

|

|

|

$- |

| 1405.3 |

Charges to this account shall include any improvements to an existing site such as buildings, landscaping, walks, etc.

Site Improvements |

|

|

|

$- |

|

|

|

|

$- |

| 1405.4 |

Includes all costs of water and utility hookups, such as waterline installation.

Water/Utility Hookups |

|

|

|

$- |

$5.00 |

|

|

|

$- |

| 1430.1 |

Enter general construction/rehabilitation contract amounts.

General Construction |

|

|

|

$- |

|

|

|

|

$- |

| 1430.2 |

Enter the costs associated with making physical improvements to property that is leased.

Leasehold Improvements |

|

|

|

$- |

|

|

|

|

$- |

| 1430.3 |

Insert the costs of building permits whenever theses charges are not included in the General Contractor's bid.

Permits |

|

|

|

$- |

|

|

|

|

$- |

| 1430.4 |

Insert Cost of Demolition and removal of Demolition materials not included in General Contractor's Bid.

Demolition |

|

|

|

$- |

|

|

|

|

$- |

| 1430.5 |

Insert costs associated with the removal of contaminated materials from the property.

Environmental Remediation |

|

|

|

$- |

|

|

|

|

$- |

| 1440.1 |

Insert costs associated with purchasing capital assets for your operations. Do not include costs for office or computer equipment.

Machinery and Equipment |

|

$50,000.00 |

|

$50,000.00 |

|

|

$55,000.00 |

|

$55,000.00 |

| 1440.2 |

Insert the costs associated with obtaining an independent professional valuation of company assests.

Appraisal (M&E) |

|

|

|

$- |

|

|

|

|

$- |

| 1450.1 |

Include all items of office equipment, dwelling equipment,such as ranges or refridgerators.

Office Equipment |

|

$10,000.00 |

|

$10,000.00 |

|

|

$8,000.00 |

|

$8,000.00 |

| 1450.2 |

Insert the cost of computer software, such as speadsheet programs, word processing programs, accounting programs, etc.

Computer Software |

|

|

|

$- |

|

|

|

|

$- |

| 1450.3 |

Insert cost of Computer equipment such as hard drives, terminals, monitors, laptops, printers, scanners, etc.

Computer Equipment |

$5,000.00 |

$10,000.00 |

|

$15,000.00 |

|

$5,000.00 |

$7,000.00 |

|

$12,000.00 |

|

|

|

|

|

$- |

|

|

|

|

$- |

|

TOTAL CAPITAL COSTS. |

$5,000.00 |

$70,000.00 |

$- |

$75,000.00 |

|

$5,000.00 |

$70,000.00 |

$- |

$75,000.00 |

|

|

|

|

|

|

|

|

|

|

|

|

WORKING CAPTAL COSTS |

|

|

|

|

|

|

|

|

|

| 1410.1 |

Insert cost of training new employees.

Training |

|

|

|

$- |

|

|

|

|

$- |

| 1410.3 |

costs associated with relocation payments to individuals or incurred for moving the business to a new location.

Relocation |

|

|

|

$- |

|

|

|

|

$- |

| 1415.2 |

Insert costs for bookkeeping services.

Accounting |

|

|

|

$- |

|

|

|

|

$- |

| 1415.3 |

Insert fees and expenses paid to an independent public accounting firm in connection with a state or federal project audit.

Audit |

|

|

|

$- |

|

|

|

|

$- |

| 1415.4a |

Fees associated with acquiring a project site or fees associated with executing a DECD closing.

Legal Fees |

$30,000.00 |

|

|

$30,000.00 |

|

$28,000.00 |

|

|

$28,000.00 |

| 1415.4b |

Legal fees DECD incurs in contract closing.

Legal-DECD |

|

|

|

$- |

|

|

|

|

$- |

| 1415.4c |

Insert costs in connection with the examination of property title.

Title Examination |

|

|

|

$- |

|

|

|

|

$- |

| 1415.4d |

Insert costs associated with recording of deeds or other instruments associated with the project.

Recording Fees |

|

|

|

$- |

|

|

|

|

$- |

| 1415.5 |

Insert the costs associated with business travel in connection with the project.

Travel |

|

|

|

$- |

|

|

|

|

$- |

| 1415.6 |

Insert rental paid for office space.

Office Rent |

$35,000.00 |

|

|

$35,000.00 |

|

$37,000.00 |

|

|

$37,000.00 |

| 1415.7 |

Insert Company's share of contribution towards a pension plan.

Pension and Other Funds |

|

|

|

$- |

|

|

|

|

$- |

| 1415.8 |

Insert company's share of health/life insurance, and other costs related to salary and wages.

Fringe Benefits |

|

|

|

$- |

|

|

|

|

$- |

| 1415.9 |

Insert the project's share of payroll taxes, including FICA, Medicare Taxes and State and Federal Unemployment Taxes.

Payroll Taxes |

|

|

|

$- |

|

|

|

|

$- |

| 1415.10 |

Insert the cost of all stationary, office supplies, postage,binders, vouchers and checks.

Office Expense |

|

|

|

$- |

|

|

|

|

$- |

| 1415.11 |

Insert costs for telephone, telegraph and messenger/answering services.

Communications |

|

|

|

$- |

|

|

|

|

$- |

| 1415.13 |

Insert the cost of insurance premiums that are not related to land or buildings.

Insurance |

|

|

$10,000.00 |

$10,000.00 |

|

|

|

$8,000.00 |

$8,000.00 |

| 1415.15 |

Insert costs associated with professional consulting services to survey, evaluate and prepare reports on anticipated market impacts. Also include costs associated with advertising products or business.

Marketing |

|

|

$50,000.00 |

$50,000.00 |

|

|

|

$52,000.00 |

$52,000.00 |

| 1415.16 |

Insert contractural services costs relating directly with the functions mof the project/program.

Contractual Services |

|

|

|

$- |

|

|

|

|

$- |

| 1420.1 |

Insert interest to be paid or accrued on loan advances from other lending institutions.

Interest Expense |

|

|

|

$- |

|

|

|

|

$- |

| 1420.2 |

Insert cost of project property and general liability insurance.

Property Insurance |

|

|

|

$- |

|

|

|

|

$- |

| 1420.3 |

Insert cost of project property taxes paid or accrued.

Taxes |

|

|

|

$- |

|

|

|

|

$- |

| 1420.4 |

If applicable, insert cost of insurance.

Environmental Insurance |

|

|

|

$- |

|

|

|

|

$- |

| 1425.1a |

Insert fees paid to the project Architect.

Design Consultant/Architect |

|

|

|

$- |

|

|

|

|

$- |

| 1425.1b |

Insert fees paid to project Engineer.

Design Consultant/Engineer |

|

|

|

$- |

|

|

|

|

$- |

| 1425.2 |

Insert costs incurred for boring or tests in connection with selection of the project site.

Environmental Testing |

|

|

|

$- |

|

|

|

|

$- |

| 1425.30 |

Insert the costs of all surveys and maps company is required to pay for in accordance with the architects agreement.

Surveys & Maps |

|

|

|

$- |

|

|

|

|

$- |

| 1435.2 |

Insert the cost of purchasing company merchandise and raw materials to made into finished goods for sale.

Inventory |

|

|

|

$- |

|

|

|

|

$- |

| 1445.1 |

Insert costs associated with discovering new knowledge about products, processes and services.

Research & Development |

|

|

|

$- |

|

|

|

|

$- |

|

TOTAL WORKING CAPITAL |

$65,000.00 |

$- |

$60,000.00 |

$125,000.00 |

|

$65,000.00 |

$- |

$60,000.00 |

$125,000.00 |

|

|

|

|

|

|

|

|

|

|

|

| 1415 |

OTHER AUTH. EXPENSES |

|

|

|

$- |

|

|

|

|

$- |

|

example: insert up to 50% salary exp or other Commissioner approved expenses.

|

|

|

|

$- |

|

|

|

|

$- |

|

example: insert up to 50% salary exp or other Commissioner approved expenses.

|

|

|

|

$- |

|

|

|

|

$- |

|

Total Other Auth. Expenses |

$- |

$- |

$- |

$- |

|

$- |

$- |

$- |

$- |

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL PROJECT COST |

$70,000.00 |

$70,000.00 |

$60,000.00 |

$200,000.00 |

|

$70,000.00 |

$70,000.00 |

$60,000.00 |

$200,000.00 |

|

|

|

|

|

|

|

|

|

|

|

| I certify that the information provided on this form is accurate and complete. False statements made in the preparation and submission of this document |

|

|

|

|

|

|

|

|

|

|

| and related materials are punishable as a Class A Misdemeanor under Connecticut General Statutes 53a-157b. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Applicant: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Printed Name and Title of Authorized Officer |

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Signature of Authorized Officer |

|

|

|

|

|

|

|

|

|

|