226x Filetype XLSX File size 0.05 MB Source: www.fcbanking.com

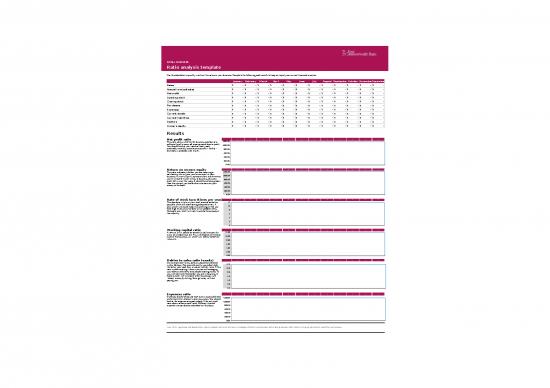

SMALL BUSINESS

Ratio analysis template

Use this calculator to quickly work out the ratios in your business. Complete the following each month to keep on top of your current financial situation.

January February March April May June July August September October NovemberDecember

Sales $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ -

Annual invoiced sales $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ -

Net profit $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ -

Opening stock $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ -

Closing stock $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ -

Purchases $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ -

Expenses $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ -

Current assets $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ -

Current liabilities $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ -

Debtors $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ -

Owner's equity $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ - $ -

Results

Net profit ratio - - - - - - - - - - - -

This ratio shows whether the business operates at a 1200.0%

sufficient level to cover all expenses and show a profit.

You should look at your ratios at least yearly, 1000.0%

preferably monthly, some businesses do it weekly - 800.0%

and daily is probably a bit much.

600.0%

400.0%

200.0%

0.0%

Return on owners equity - - - - - - - - - - - -

This ratio indicates whether you are receiving a 1200.0%

satisfactory return from your investment in your

business. Owner’s Equity represents how much money 1000.0%

you’ve invested to start or buy a business, plus any 800.0%

profit left in over the years. It should be at least greater

than the interest you could otherwise earn on your 600.0%

money at the bank.

400.0%

200.0%

0.0%

Rate of stock turn (times per year) - - - - - - - - - - - -

The idea here is to turn your stock around as fast as 12

possible while still maintaining adequate levels. A

slow stock turn could mean overstocking or that you 10

hold high levels of out-of-date or un-saleable items. 8

Compare your stock turn rate to similar businesses in

the industry. 6 - - - - - - - - - - - -

4

2

0

Working capital ratio - - - - - - - - - - - -

A ratio of 2 to 1 should be aimed for, ($2 in assets for 12.00

every $1 of liabilities), but this will depend on the cash

cycle of the business, i.e., stock turn, debtor collection 10.00

times, etc. 8.00

6.00 - - - - - - - - - - - -

4.00

2.00

0.00

Debtor to sales ratio (weeks) - - - - - - - - - - - -

On normal credit terms, debtors should be collected

within 40 days. The more efficiently you collect debt, 12.0

the better your cash flow situation is likely to be. If this 10.0

ratio is deteriorating it shows you are not managing

your debtors efficiently and people loaning money to 8.0

you will take note. Remember you are in business to

make a profit, not to finance other businesses with 6.0

"cheap" money by letting them get away with not

paying you. 4.0

2.0

0.0

Expenses ratio - - - - - - - - - - - -

Expenses should always be kept as low as possible and 1200.0%

under control in relation to previous years. You should

look at the expense ratio particularly if the net profit 1000.0%

ratio shows a downward trend. Different items of

expenditure can also be calculated on this basis. 800.0%

600.0%

400.0%

200.0%

0.0%

Note. This is a guide only and should neither replace competent advice, nor be taken or relied upon as financial or professional advice. Seek professional advice before making any decision that could affect your business.

no reviews yet

Please Login to review.