213x Filetype XLSX File size 0.04 MB Source: ir.hellofreshgroup.com

Sheet 1: IS in %

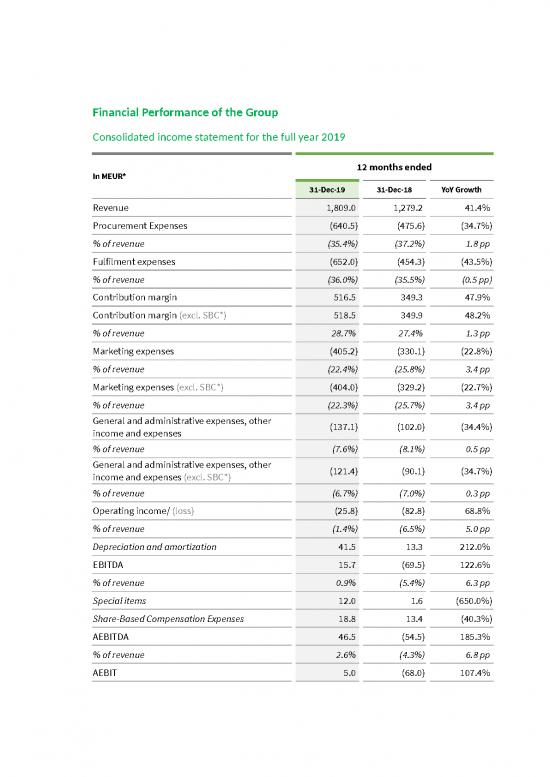

| Financial Performance of the Group | |||||||

| Consolidated income statement for the full year 2019 | |||||||

| In MEUR* | 12 months ended | ||||||

| 31-Dec-19 | 31-Dec-18 | YoY Growth | |||||

| Revenue | 1,809.0 | 1,279.2 | 41.4% | ||||

| Procurement Expenses | (640.5) | (475.6) | (34.7%) | ||||

| % of revenue | (35.4%) | (37.2%) | 1.8 pp | ||||

| Fulfilment expenses | (652.0) | (454.3) | (43.5%) | ||||

| % of revenue | (36.0%) | (35.5%) | (0.5 pp) | ||||

| Contribution margin | 516.5 | 349.3 | 47.9% | ||||

| Contribution margin (excl. SBC*) | 518.5 | 349.9 | 48.2% | ||||

| % of revenue | 28.7% | 27.4% | 1.3 pp | ||||

| Marketing expenses | (405.2) | (330.1) | (22.8%) | ||||

| % of revenue | (22.4%) | (25.8%) | 3.4 pp | ||||

| Marketing expenses (excl. SBC*) | (404.0) | (329.2) | (22.7%) | ||||

| % of revenue | (22.3%) | (25.7%) | 3.4 pp | ||||

| General and administrative expenses, other income and expenses | (137.1) | (102.0) | (34.4%) | ||||

| % of revenue | (7.6%) | (8.1%) | 0.5 pp | ||||

| General and administrative expenses, other income and expenses (excl. SBC*) | (121.4) | (90.1) | (34.7%) | ||||

| % of revenue | (6.7%) | (7.0%) | 0.3 pp | ||||

| Operating income/ (loss) | (25.8) | (82.8) | 68.8% | ||||

| % of revenue | (1.4%) | (6.5%) | 5.0 pp | ||||

| Depreciation and amortization | 41.5 | 13.3 | 212.0% | ||||

| EBITDA | 15.7 | (69.5) | 122.6% | ||||

| % of revenue | 0.9% | (5.4%) | 6.3 pp | ||||

| Special items | 12.0 | 1.6 | (650.0%) | ||||

| Share-Based Compensation Expenses | 18.8 | 13.4 | (40.3%) | ||||

| AEBITDA | 46.5 | (54.5) | 185.3% | ||||

| % of revenue | 2.6% | (4.3%) | 6.8 pp | ||||

| AEBIT | 5.0 | (68.0) | 107.4% | ||||

| % of revenue | 0.3% | (5.3%) | 5.6 pp | ||||

| *Net of share-based compensation expenses | |||||||

| Financial Performance of the US Segment | ||||||

| Consolidated income statement for the full year 2019 | ||||||

| In MEUR* | 12 months ended | |||||

| 31-Dec-19 | 31-Dec-18 | YoY Growth | ||||

| Revenue | 1,024.8 | 733.8 | 39.7% | |||

| Procurement Expenses | (321.1) | (247.6) | (29.7%) | |||

| % of revenue | (31.3%) | (33.7%) | 2.4 pp | |||

| Fulfilment expenses | (402.3) | (279.1) | (44.1%) | |||

| % of revenue | (39.3%) | (38.0%) | (1.2 pp) | |||

| Contribution margin | 301.4 | 207.1 | 45.5% | |||

| Contribution margin (excl. SBC*) | 302.4 | 207.4 | 45.8% | |||

| % of revenue | 29.5% | 28.3% | 1.2 pp | |||

| Marketing expenses | (276.1) | (215.3) | (28.2%) | |||

| % of revenue | (26.9%) | (29.3%) | 2.4 pp | |||

| Marketing expenses (excl. SBC*) | (275.6) | (214.8) | (28.3%) | |||

| % of revenue | (26.9%) | (29.3%) | 2.4 pp | |||

| General and administrative expenses, other income and expenses | (46.8) | (34.9) | (34.1%) | |||

| % of revenue | (4.6%) | (4.8%) | 0.2 pp | |||

| General and administrative expenses, other income and expenses (excl. SBC*) | (44.7) | (34.6) | (29.2%) | |||

| % of revenue | (4.4%) | (4.7%) | 0.4 pp | |||

| Operating income/ (loss) | (21.4) | (43.0) | 50.2% | |||

| % of revenue | (2.1%) | (5.9%) | 3.8 pp | |||

| Depreciation and amortization | 15.9 | 6.3 | 152.4% | |||

| EBITDA | (5.5) | (36.7) | 85.0% | |||

| % of revenue | (0.5%) | (5.0%) | 4.5 pp | |||

| Special items | 10.8 | 2.5 | (332.0%) | |||

| Share-Based Compensation Expenses | 3.6 | 1.0 | (260.0%) | |||

| AEBITDA | 8.9 | (33.2) | 126.8% | |||

| % of revenue | 0.9% | (4.5%) | 5.4 pp | |||

| AEBIT | (7.0) | (39.5) | 82.3% | |||

| % of revenue | (0.7%) | (5.4%) | 4.7 pp | |||

| *Net of share-based compensation expenses | ||||||

| Financial Performance of the International Segment | ||||||

| Consolidated income statement for the full year 2019 | ||||||

| In MEUR* | 12 months ended | |||||

| 31-Dec-19 | 31-Dec-18 | YoY Growth | ||||

| Revenue (total) | 785.1 | 545.9 | 43.8% | |||

| Revenue (external) | 784.2 | 545.4 | 43.8% | |||

| Procurement Expenses | (319.0) | (227.2) | (40.4%) | |||

| % of revenue | (40.6%) | (41.6%) | 1.0 pp | |||

| Fulfilment expenses | (248.1) | (173.4) | (43.1%) | |||

| % of revenue | (31.6%) | (31.8%) | 0.2 pp | |||

| Contribution margin | 218.0 | 145.2 | 50.1% | |||

| Contribution margin (excl. SBC*) | 218.6 | 145.6 | 50.1% | |||

| % of revenue | 27.8% | 26.7% | 1.1 pp | |||

| Marketing expenses | (123.6) | (109.5) | (12.9%) | |||

| % of revenue | (15.7%) | (20.1%) | 4.3 pp | |||

| Marketing expenses (excl. SBC*) | (123.2) | (109.3) | (12.7%) | |||

| % of revenue | (15.7%) | (20.1%) | 4.4 pp | |||

| General and administrative expenses, other income and expenses | (86.9) | (42.0) | (106.9%) | |||

| % of revenue | (11.1%) | (7.7%) | (3.4 pp) | |||

| General and administrative expenses, other income and expenses (excl. SBC*) | (33.2) | (22.1) | (50.2%) | |||

| % of revenue | (4.2%) | (4.1%) | (0.1 pp) | |||

| Operating income/ (loss) | 7.5 | (6.3) | 219.0% | |||

| % of revenue | 1.0% | (1.1%) | 2.0 pp | |||

| Depreciation and amortization | 19.6 | 3.9 | 402.6% | |||

| EBITDA (excluding platform fee & holding mark-up) | 80.1 | 15.3 | 423.5% | |||

| % of revenue | 10.2% | 2.8% | 7.4 pp | |||

| Special items | 0.8 | (2.3) | 134.8% | |||

| Share-Based Compensation Expenses | 2.3 | 1.9 | 21.1% | |||

| AEBITDA** | 83.2 | 14.9 | 458.4% | |||

| % of revenue | 10.6% | 2.7% | 7.9 pp | |||

| AEBIT** | 63.6 | 12.7 | 400.8% | |||

| % of revenue | 8.1% | 2.3% | 5.8 pp | |||

| *Net of share-based compensation expenses | ||||||

| **excluding holding fees | ||||||

no reviews yet

Please Login to review.